E-Invoicing in Austria

Last update: 2024, August 27

Summary

B2G

Mandatory

Mandatory since 2014 through the e-rechnung.gv.at central platform or the Peppol network, depending on the targeted public administration.

Invoice format is either the local ebInterface format or Peppol BIS 3.0.

B2B

Allowed

Currently allowed using EDI, e-signature or guaranteeing a complete audit trail, but not mandatory.

What the Law Says

B2G E-Invoicing

B2G e-invoicing has been mandatory at the federal level in Austria since 2014, following the publication of the IKT Konsolidierungsgesetz (§5).

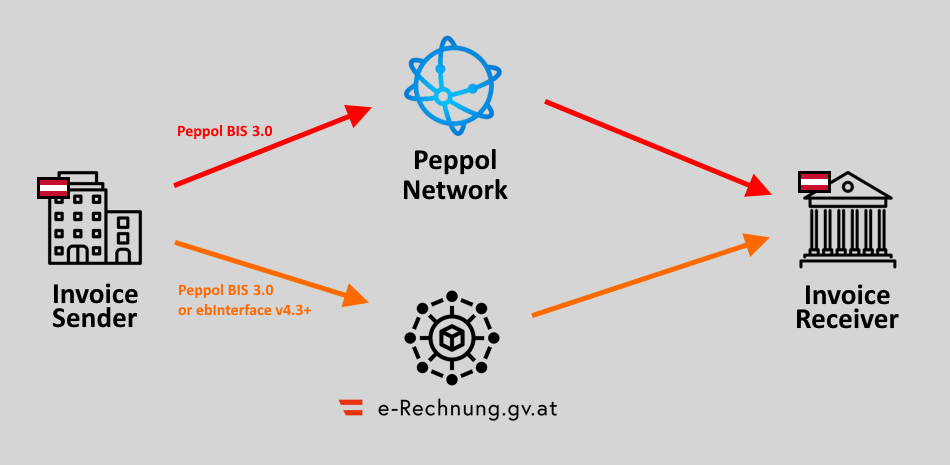

E-invoices to Austrian public administrations can be submitted via the Peppol network using the Peppol BIS format.

Alternatively, federal public administrations and several local public administrations can be reached through the e-rechnung.gv.at central platform. It accepts both the Peppol BIS 3.0 and the local ebInterface (v4.3 and above) invoice formats, with the latest versions of these formats being respectively compliant (Peppol) and compatible (ebInterface) with the European Norm (EN) 16931.

E-invoicing is however not mandatory for local public administrations, although it is accepted by many of them through the Peppol network.

All invoices must be archived for 7 years.

B2B E-Invoicing

There is no B2B e-invoicing mandate in Austria, nor is there a plan to implement one in the future.

Consequently, businesses can transmit B2B invoices in the following ways:

- Paper-based invoices

- PDF invoices with e-signature or complete audit trail

- EDI, for example via the Peppol network

Timeline

B2G E-Invoicing mandatory

Legacy Formats Deprecated

Technical Details

Peppol Network & Certification

Comprehensive guidelines are available and maintained on the e-rechnung.gv.at central platform, providing more ample information.

E-Invoicing via the Peppol network

All Austrian federal public administrations are reachable through the Peppol network, as well as many local public administrations.

The Peppol Directory can be used to identify all Peppol participants.

E-invoices must be sent in Peppol BIS 3.0 format.

E-Invoicing via the Central Platform

All federal public administrations and several local public administrations are also reachable through the e-rechnung.gv.at central platform, administered by the BMF (Ministry of Finance).

The central platform requires initial user authentication through the Unternehmensservice Portal (USP – Business Service Portal). Alternatively, companies can avoid this authentication step by using service providers that are registered with the USP (complete list).

Once authenticated, companies can choose from the following invoice delivery methods to the central platform:

- Manual input in an online form

- Manual upload of an e-invoice

- Automated transmission via webservice

- The local ebInterface format, developed and maintained by the AUSTRIAPRO association.

- Legacy versions (v4.2 and below) were deprecated in 2022.

- The currently accepted versions are v4.3, 5.0, 6.0 and the latest 6.1 version.

- Versions 5.0 and above are compatible with the EN 16931 in the sense that they can be transformed into EN16931-compliant invoices.

- The Peppol BIS 3.0 format, compliant with the EN 16931.

- An Austrian “Core Invoice Usage Specification (CIUS)” implementing national additional restrictions is available in 2 layers: CIUS AT NAT (for B2B use) and CIUS AT GOV (additional rules for B2G)

- See more details on EN 16931 compliance (German only)

Depending on the targeted public administration, some additional fields may need to be included in the e-invoice, such as the Purchase Order reference and the Supplier number, or special fields tied to the BBG (Austria Public Procurement Agency).

The Invoicing Hub Word

Austria

With more than a decade since B2G e-invoicing was made mandatory at the federal level, Austria has been a leading early adopter of e-invoicing in Europe.

The government provides comprehensive guidelines, responsive support, and diverse options for companies to submit their e-invoices to public administrations, ranging from manual input to automated submission via web service or the Peppol network.

In essence, B2G e-invoicing at the Austrian federal level operates smoothly. But despite this early implementation, the Austrian government has not progressed beyond this stage, and no further e-invoicing mandates have been introduced.

As a result, traditional (non-electronic) invoicing remains prevalent in Austria, with no current plans for broader B2G or B2B mandates. Consequently, widespread adoption of e-invoicing in Austria does not appear to be in the cards for the foreseeable future.

Additional Resources

Public entity supervising e-invoicing in Austria

Association promoting e-invoicing and in charge of the ebInterface format

B2G central platform & official B2G e-invoicing guidelines

Authentication portal used by the B2G central platform

List of accepted B2G e-invoice formats & their specifications

B2G e-invoicing delivery methods specifications

Entire set of official Peppol BIS 3.0 specifications

Official directory of worldwide Peppol-ready businesses

Get your Project Implemented

Gold Sponsor

Silver Sponsors

Advertisement

Latest News - Austria

OpenPeppol conference 2025 – Brussels, June 17-18

ViDA formally published

ViDA clears final step in European Council

EU Parliament approves latest ViDA updates

Next E-Invoicing Exchange Summit to take place in Dubai (Feb. 10-12, 2025)

The Invoicing Hub

experts can help you

Strategy, Guidance, Training, …