The announcements from the DGFiP made in Q4 2024 bring significant changes to France’s e-invoicing and e-reporting mandates.

Continue readingFrance set to become a Peppol Authority

The future Peppol authority will govern PDP interoperability and ensure network readiness for France’s upcoming e-invoicing mandate.

Continue readingFrance reveals a significantly scaled-back scope for its B2B central platform

The PPF will only manage the central directory and receive invoice tax data, while the PDPs will process invoices for all companies countrywide.

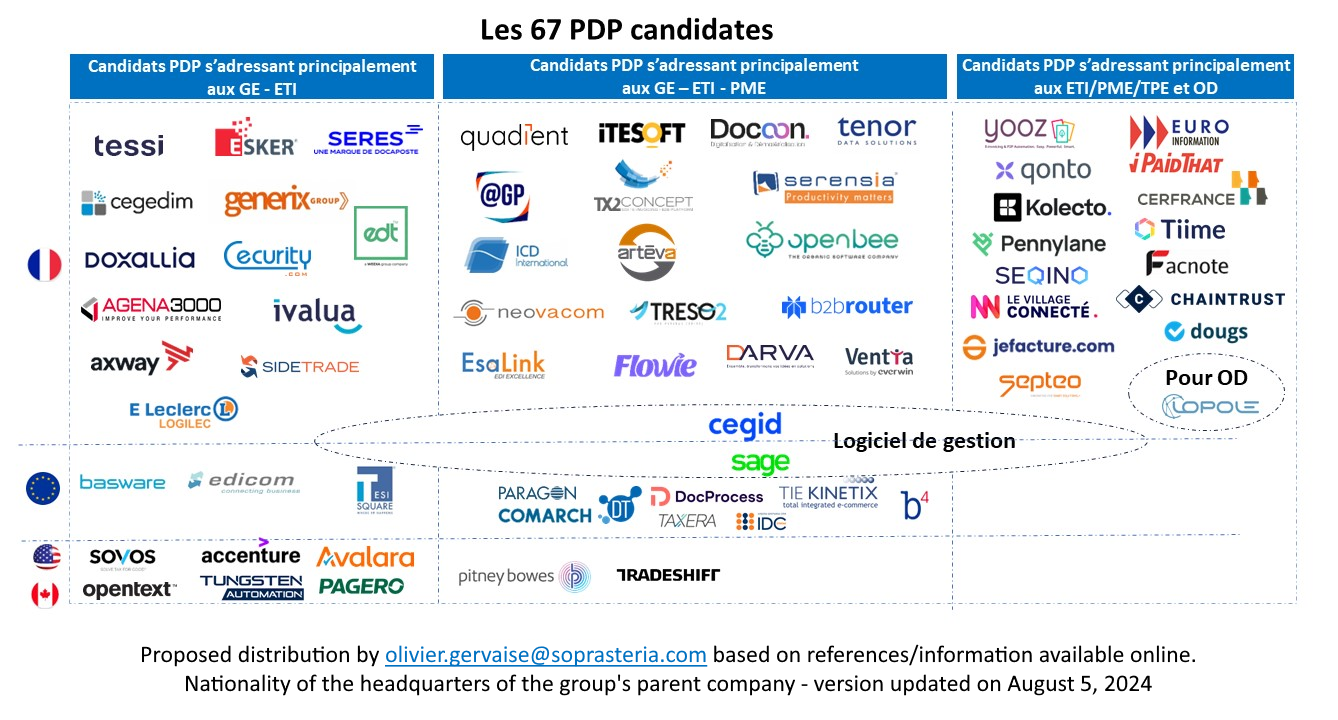

Continue readingFrance unveils a first list of 60+ PDPs

All the PDPs in the list are provisionally registered until further connectivity tests are validated in 2025.

Continue readingFrance begins official registration of PDPs

French authorities started certifying Digital Public Platforms (PDPs), as service providers reported receiving approvals throughout August.

Continue readingRelease of updated french B2B mandate specifications (v2.4)

The latest version 2.4 of the French B2B e-invoicing mandate specifications has been eagerly anticipated and is now available for download on the DGFiP portal.

Continue readingThe official mandate postponement decree introduces new PDP specifications

The French government has issued an official decree confirming the delay of the France B2B e-invoicing mandate and has additionally provided new details regarding PDPs.

Continue readingFrance DGFiP challenging 5 common misconceptions about B2B mandate

The French tax authority (DGFiP) has released five PDFs aimed at raising awareness around five common misconceptions on the upcoming B2B e-invoicing mandate.

Continue readingFrance B2B mandate: recent calendar updates

The French B2B mandate will be implemented in 2026 & 2027

Continue reading