E-Invoicing in Denmark

Last update: 2025, March 31

Summary

B2G

Mandatory

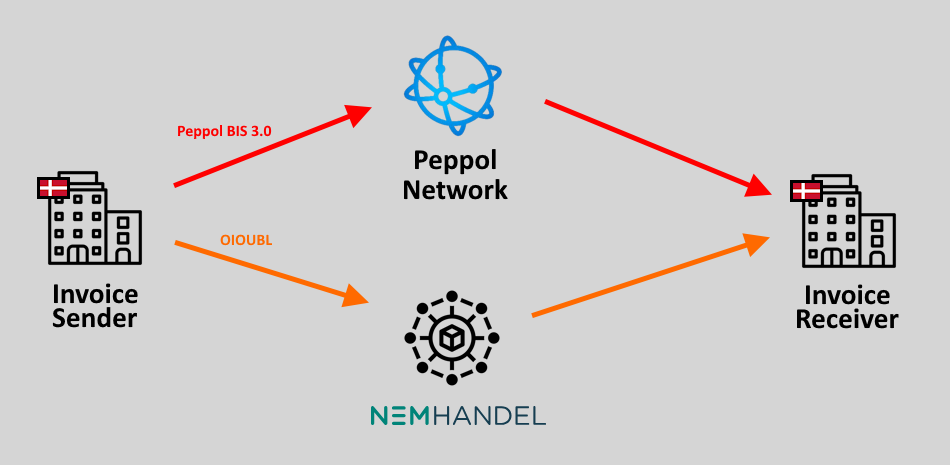

Mandatory via the Peppol network or the national NemHandel platform, either in Peppol BIS 3.0 or in OIOUBL format.

B2B

Partially mandatory

Will progressively become mandatory between 2024 & 2026 using certified software.

What the Law Says

B2G E-Invoicing

E-Invoicing has been mandatory in Denmark for all B2G transactions since 2005 already.

Denmark has implemented a central platform called “NemHandel” to enable the sending & reception of e-invoices, but it is also possible to use the Peppol network as it is interconnected with the NemHandel platform.

E-invoices must be sent either in Peppol BIS 3.0 format (compliant with the European Norm (EN) 16931) or in the local OIOUBL format. A version 3.0 of the OIOUBL format, compliant with the EN 16931, will gradually become mandatory over 2025 & 2026.

Invoices must be archived for 5 years in most cases.

B2B E-Invoicing

E-Invoicing is currently well developed in Denmark, but not mandatory yet. Therefore, invoices can be issued currently using any of the following ways:

- Paper-based invoices

- PDF invoices with e-signature or complete audit trail

- EDI

However, this will change soon as a new law called the “Bookkeeping Act” was adopted in 2022, and will require accounting to be performed digitally using:

- Either a digital bookkeeping software certified by the “Erhvervsstyrelsen” (or “ERST”, the Danish Business Authority)

- Or a individual digital bookkeeping solution developed in compliance with the law

The law covers all accounting processes, including invoicing. Consequently, B2B e-invoicing will also become mandatory, following the same principles as for B2G transactions.

E-invoices will have to be transmitted via either the public NemHandel platform or via the Peppol network. The invoice format is required to be either Peppol BIS 3.0 (EN16931-compliant) or the local OIOUBL format (with an upcoming 3.0 version that will also be EN16931-compliant).

The Bookkeeping Act will apply from the first accounting or income period starting after the deadlines listed below. It will be a staged roll-out, depending on the company size and on the digital bookkeeping solution a company opts for.

The current calendar is the following:

- 2024, January 1: publication of all certified digital bookkeeping systems

- 2024, July 1: medium & large companies* using a certified accounting software

- 2025, January 1: medium & large companies* using their own custom software

- 2026, January 1: financial companies (any size) and personally-owned companies with an annual turnover in 2024 & 2025 of more than 300,000 DKK (~40,000 € as of Jan. 2024)

* “Medium & large companies” in this context correspond to companies already subject to an annual report according to the Annual Accounts Act. Invoices must be archived for 5 years in most cases.

Timeline

B2G Mandatory

E-invoices can be sent via the Peppol network or the central NemHandel platforrm.

B2G Mandatory Using EN16931-Compliant Formats

B2B Mandatory - Medium & Large Companies with Certified Software

B2B Mandatory - Medium & Large Companies with Own Software

OIOUBL 3.0 becomes mandatory for OIOUBL invoices

B2B Mandatory for All Companies

OIOUBL 2.1 becomes deprecated

Technical Details

Mandatory E-Invoicing

E-invoicing is already mandatory for all B2G transactions in Denmark, and will soon be for all B2B transactions.

Also, according to the upcoming Bookkeeping Act, the entire invoicing process will have to be managed using a certified digital bookkeeping solution or a homemade solution specifically developped in compliance with the law.

Choosing the Proper Platform

Both the current B2G e-invoicing mandate and the upcoming Bookkeeping Act state that e-invoices will have to be transmitted using:

- The Peppol network

- Or the NemHandel central platform built by the Danish government

Peppol and NemHandel are 2 similar implementations of the four-corner model. However, while most Danish public administrations are reachable via Peppol, it’s not yet the case for 100% of them.

Consequently, the NemHandel platform may seem the best e-invoicing choice in Denmark. However, the Danish government has announced that at some point, when Peppol will have reached a sufficient level of functionalities, the NemHandel platform will be discontinued. It’s not planned for the next years, but it’s something to keep in mind.

Company Identifiers as Electronic Address

To check the availability of any public administration on either of these networks / platforms, you can use the Peppol Directory or the NemHandelsregisteret (NemHandel online directory). Danish private companies & public entities are identified with their GLN (Global Location Number) or their CVR number (Centrale Virksomhedsregister, the Danish Central Business Register).

E-Invoice Content

All electronic invoices in Denmark will have to be issued in one of the following formats:

- The Peppol BIS 3.0 format, EN16931-compliant, to be used on the Peppol network

- Or the OIOUBL 2.1 format, to be used on the NemHandel network, and which is comprised of more fields to cover Danish requirements more closely. Since May 2022, OIOUBL version 2.1 is valid and in use.

A version 3.0 of the OIOUBL format, compliant with the EN 16931, was released in November 2024 and will become mandatory in November 2025. This migration plan corresponds to a 6-months delay compared to the initial timeline, with the possibility of further adjustments based on testing and quality assurance outcomes of the OIOUBL 3.0 format by the ERST (Danish Business Authority).

E-invoicing in Denmark Overview

The Invoicing Hub Word

Denmark

Denmark and all the Nordics countries have been pioneers of electronic invoicing. E-invoicing even became mandatory for all B2G transactions with central public administrations as early as 2005, which puts Denmark at the forefront of e-invoicing in Europe and even in the world!

And now Denmark is going one step forward, or should we say several steps forward at once. Indeed, the new “Bookkeeping Act” will move a lot of business processes onto the digital road, and among them the invoicing.

However, this law is very monolithic and can make things very complicated for companies, service providers and software developers. Indeed, the main principle of this law is to mandate the use of a certified solution, or to let companies build their own solution in compliance with the law.

As such, many companies will be led to choose comprehensive solutions that handle all the accounting processes, but such a solution does not exist. There are invoicing software, ordering software, treasury management systems, etc., and not one solution covers properly all the accounting processes.

Consequently, this new law may reduce the granularity of the solution landscape that companies have at their disposal, and force them either to move to sub-par do-it-all solutions, or to build their own solution at their own expense & risk.

Similarly, this law has a huge impact on service providers by almost closing the Danish market to many of them: the ones that won’t be able to find a partnership with a bookkeeping software editor. It may lead to a lack of competition and possibly later to a drop in quality of all accounting solutions (including the e-invoicing solutions) on the Danish market.

Additional Resources

Public entity supervising e-invoicing in Denmark

Requirements for digital standard bookkeeping systems & text of the Bookkeeping Act

Continuously updated list of registered bookkeeping systems

Official directory of entities connected to NemHandel

Official directory of worldwide Peppol-ready businesses

Entire set of official Peppol BIS 3.0 specifications

“Release Candidate” OIOUBL 3.0 specifications (Danish only)

Official OIOUBL 2.1 specifications (Danish only)

Get your Project Implemented

Gold Sponsor

Silver Sponsors

Advertisement

Latest News - Denmark

OpenPeppol conference 2025 – Brussels, June 17-18

[UPDATED] New OIOUBL 3.0 invoice standard released in Denmark

ViDA formally published

ViDA clears final step in European Council

EU Parliament approves latest ViDA updates

The Invoicing Hub

experts can help you

Strategy, Guidance, Training, …