E-invoicing Network Models

Last update: 2024, November 13

Summary

The process of sending and receiving invoices involves multiple components.

In some cases, the seller and buyer interact directly, using “point-to-point interoperability.” Other times, they may utilize more scalable solutions, such as decentralized networks.

These approaches are categorized based on the number of corners (communication nodes) involved, ranging from 2- to 5-corner network models.

What are "Network Models"?

All businesses inevitably talk to many business partners, inherently forming and participating in a “network of communication”. The methods used to send and receive business documents are usually diverse, ranging from “traditional” communication methods like postal letters, fax and emails to using web portals and specialized electronic delivery networks.

Over time, and depending on the technical and organizational approach used, multiple topologies of networks have emerged, each with characteristic features, benefits and challenges.

These various network topologies are particularly relevant to business processes such as e-invoicing. E-invoicing requires the secure, accurate, and efficient exchange of invoices between buyers and sellers. Depending on the chosen e-invoicing model, businesses can optimize their invoicing processes, enhance compliance, reduce errors, and lower operational costs.

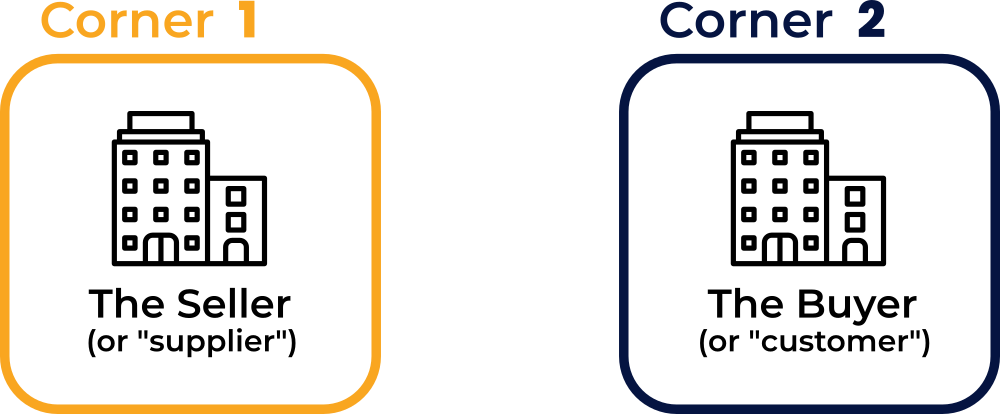

To classify those network topologies, the terminology of counting the corners of communication has emerged. These so-called corners basically correspond to the number of communicating organizations involved the document delivery process:

The Seller

(or “supplier”)

The company sending the invoices

The Buyer

(or “customer”)

The company receiving the invoices

Service Providers

(if used by any of the trading partners)

EDI provider, automation software, …

Governance Body

(if required)

National tax authority, customs administration, …

The Seller

(or “supplier”)

The company sending the invoices

The Buyer

(or “customer”)

The company receiving the invoices

Service Providers

(if used by any of the trading partners)

EDI provider, automation software, …

Governance Body

(if required)

National tax authority, customs administration, …

2-Corner Models

Point-To-Point Interoperability ("Classic EDI")

Description

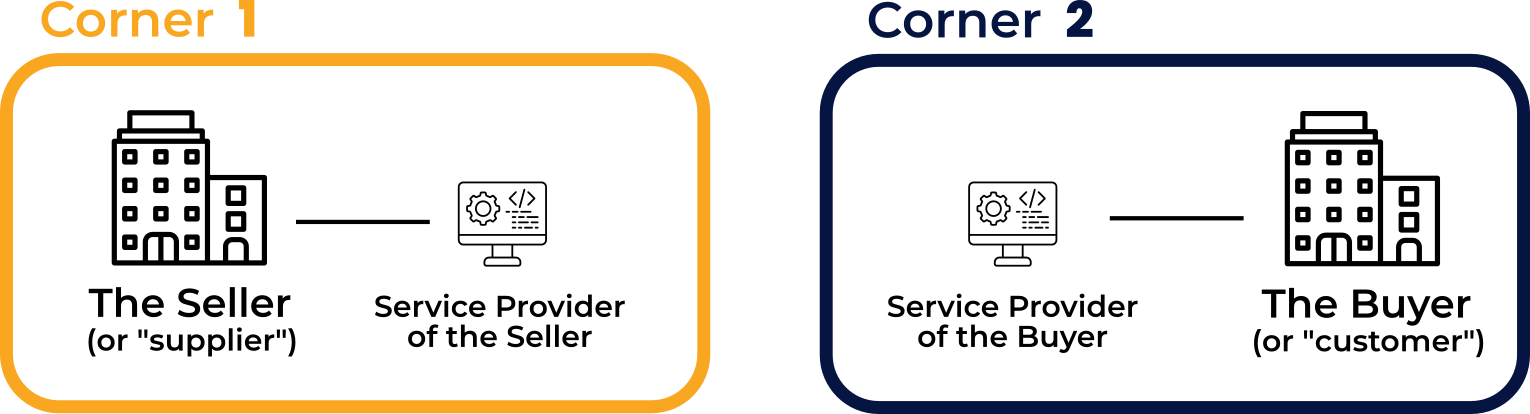

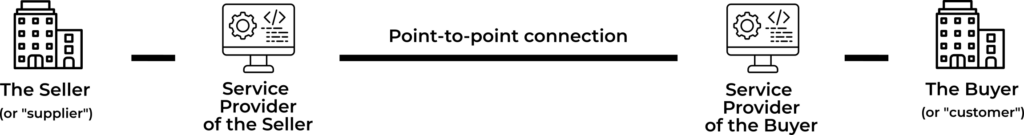

The 2-corner model represents the most straightforward form of e-invoicing, where the buyer and seller exchange invoices directly in a “point-to-point” setup. This direct approach involves no intermediary, necessitating that both parties use compatible technology and standards to ensure interoperability.

Tip: pause the animation below by putting your mouse or finger on the image

In this model, both the buyer and the seller must agree on the format and method of Electronic Data Interchange (EDI). This approach can be efficient for businesses with a limited number of trading partners, exchanging high volumes of transactions aiming at a high degree of automation, and therefore requires well-aligned organizational and technological capabilities.

However, as the number of partners increases, maintaining these direct connections including inevitably partner-specific customizations, becomes challenging, leading to scalability issues. And despite its simplicity, the 2-corner model requires both parties to invest in compatible systems and maintain them, which can be a significant barrier for smaller businesses.

Disambiguation

Classic EDI

The 2-corner model has been the go-to approach for electronic invoicing, as well as for other business processes like payments and supply chain management, for the past 30 years. This direct, point-to-point model has been widely adopted across various industries, with a lot of success specifically in Retail, Healthcare and Automotive industries. Due to its extensive use and straightforward implementation, this approach is commonly known as “Classic EDI“.

As international trade grows and compliance requirements gain complexity with e-invoicing mandates across different countries, the limitations of Classic EDI become increasingly apparent. The difficulties of managing multiple direct, often highly customized, connections while navigating diverse regulatory environments all increase the complexity, leading businesses to explore alternative network models that offer greater efficiency and scalability.

3-Corner Models

"Value-Added Networks" or Government Central Platforms

Description

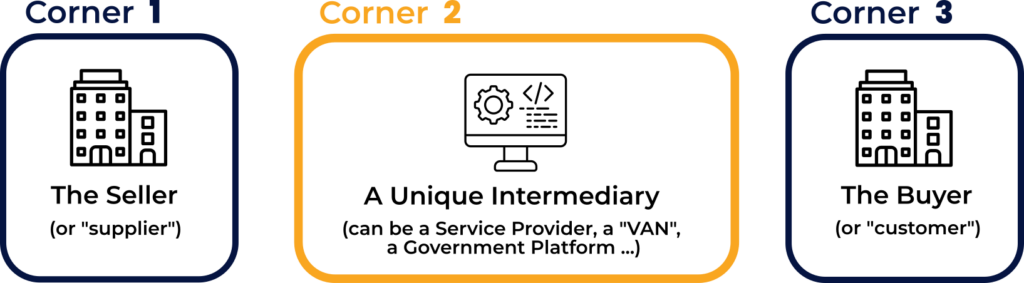

In the 3-corner model, a unique intermediary or service provider manages the exchange of e-invoices between buyers and sellers, handling tasks like transmission, translation, and validation. This middleman simplifies communication by decoupling the seller and buyer in regards of transmission, formats and standards, making information exchange more seamless.

Tip: pause the animation below by putting your mouse or finger on the image

This model benefits businesses looking to avoid investment in their own e-invoicing systems and insulating from ongoing change management with their business partners. The service provider offers added value through data validation, error checking, and document archiving, while also enhancing security and compliance.

However, the coverage of business partners is limited by the service provider’s capacity to connect them. The business may need to connect to multiple Service Providers to achieve sufficient coverage, falling back into the 2-corner model complexity. Also, use of an intermediary introduces extra costs and concerns regarding its reliability and performance. Such dependencies on a single (or very few) vendors and potential bottlenecks may be considered a drawback for some businesses.

Value-Added Networks (VANs)

In a 3-corner model network, the role of the third corner is typically filled by a single service provider that both trading partners use. This setup is often initiated by one of the partners, usually the larger one, who selects a provider that meets its specific needs and then forces its trading partners (typically smaller) to use it.

Some e-procurement service providers (i.e. the buyer side) have specialized in this model and market their services as “Value-Added Networks.” Over time, these providers have gained substantial market shares, establishing connections with a significant number of companies and positioning themselves to offer VAN services to large organizations.

While a VAN serves both the buyer and the supplier, it actually creates an asymmetrical relationship. The buyer, who selects the VAN, gains most of the benefits in terms of features, automation, and pricing. Meanwhile, the suppliers, usually smaller businesses, must adapt to the VAN requirements, go through the complex step of a building a point-to-point connection, and often bear the cost of a service they did not choose.

Governments Central Platforms (E-Invoicing Mandates)

Many countries around the world have introduced e-invoicing mandates, making e-invoicing compulsory either between public administrations and their suppliers (B2G) or between all companies (B2B).

To support these mandates, governments have established central platforms that companies must use to submit their invoices. These platforms ensure invoice clearance, while sending relevant invoice data to the tax authorities in order to help prevent potential VAT fraud by companies.

In such scenarios, the government’s central platform effectively serves as the third corner in e-invoicing transactions between companies or entities. For example, Italy‘s nationwide B2B e-invoicing mandate is facilitated by the SDI central platform. Similarly, France and Belgium, among many others, have mandated the use of central platforms for B2G e-invoicing: Chorus Pro in France and Mercurius in Belgium.

4-Corner Models

Decentralized Networks (eDelivery, Peppol, DBNA, ...)

Description

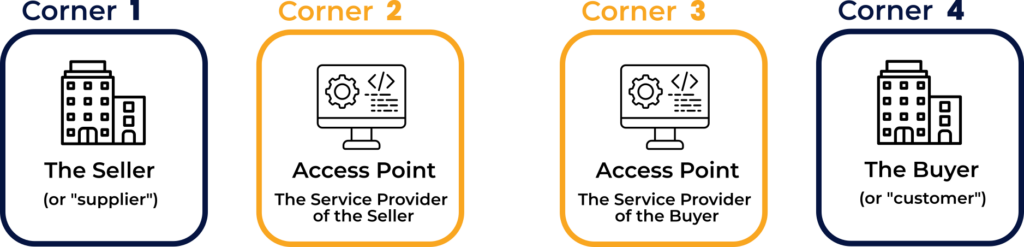

In the 4-corner model, each party selects a service provider that best meets its needs, allowing for greater customization and flexibility. The service providers are mutually responsible for ensuring that the e-invoices are transmitted correctly, securely, and in a standardized interoperability network between them. This model greatly enhances scalability, as businesses can manage relationships with multiple trading partners through their respective service providers without needing to establish direct connections with each partner.

Tip: pause the animation below by putting your mouse or finger on the image

One of the significant advantages of this model is the enhanced security and compliance it offers. Each service provider ensures that the data is transmitted securely and that all regulatory requirements are met. However, this increased complexity can also lead to higher costs, as businesses must pay for the services of their respective service providers. Additionally, effective coordination between the service providers is essential to ensure seamless communication and interoperability.

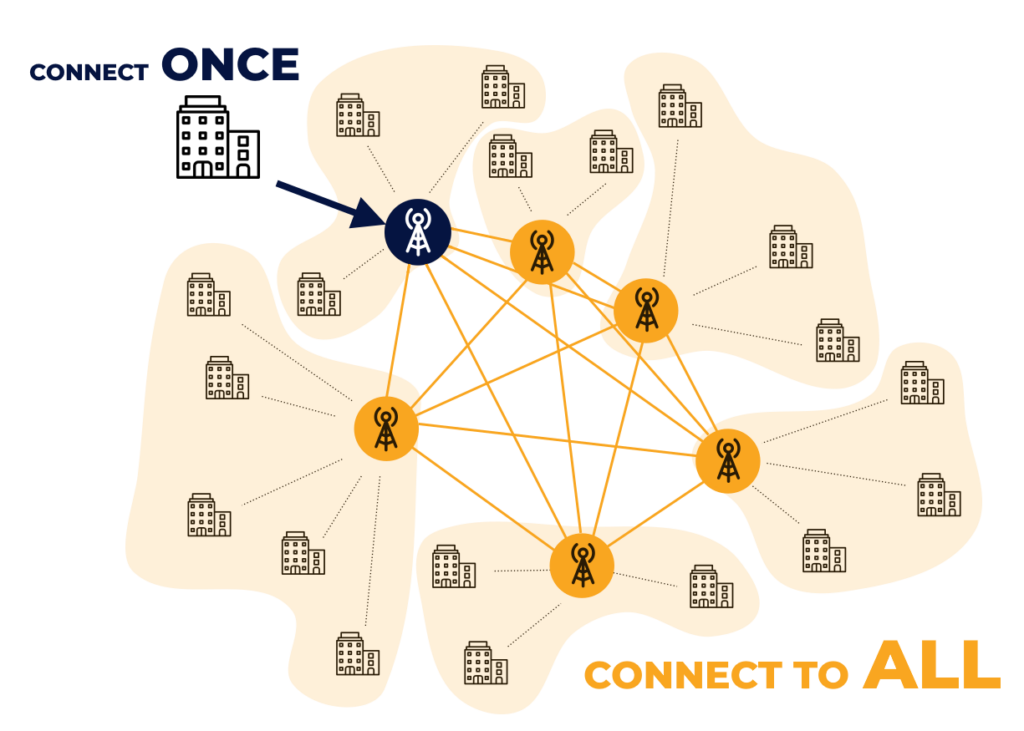

Decentralized Networks

The 4-corner model is exemplified by networks like Peppol or DBNAlliance, which standardize communication protocols to ensure smooth interaction between different service providers, known as Access Points. These decentralized networks operate on the “connect once, connect to all” principle, which captures a major advantage of this model. By connecting with a single Access Point, businesses gain access to the entire network and can exchange electronic documents—such as e-invoices and purchase orders—with any participant, regardless of their Access Point. The network also requires use of dynamic discovery mechanisms to enable automatic setup of Service Provider connections.

This approach eliminates the need for businesses to establish and maintain multiple direct connections with each trading partner. Instead, the single connection to an Access Point acts as a gateway to a broader ecosystem of interconnected Service Providers and their connected businesses. All Service Providers are certified and adhere to Peppol’s standardized protocols and formats, simplifying the process and enhancing interoperability across the network, while allowing individual flexibility between each participant and their selected Service Provider.

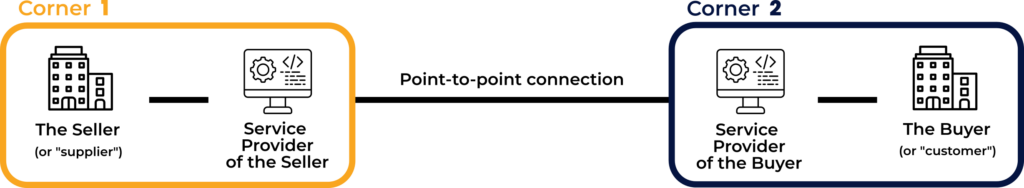

Disambiguation: Point-To-Point Interoperability With 2 Service Providers

While it might appear that having two businesses, each with its own service provider, connected via “Classic EDI” constitutes a 4-corner model, this scenario does not meet the true definition. In such cases, the service providers act merely as extensions of the businesses using a direct point-to-point connection, as in a regular 2-corner model (or a 3-corner model in the case of a VAN). In particular, the specifics of the connection between the 2 Service Providers is bilaterally agreed and implemented without further harmonization with other connections. There is no discovery and automated connectivity management.

2 companies using service providers do not make a 4-corner model, even though there are 4 communicating parties.

Such a structure involving a point-to-point connection actually corresponds to the 2-corner model

Genuine 4-corner models refer to decentralized networks that operate on the “connect once, connect to all” principle, such as the Peppol network or the DBNA network. These networks ensure homogeneous interoperability between all participating service providers, allowing businesses to connect once and interact with any partner within the network, thereby providing true scalability and flexibility.

5-Corner Models

Decentralized Networks including E-Reporting (DCTCE)

Description

The 5-corner model introduces an additional layer of e-reporting obligations to the traditional 4-corner model. In this framework, a government entity, typically the tax authority, acts as the 5th corner of the network and receives the tax data (as part of Continuous Transaction Controls or CTC) for all invoices passing through the system.

The 5-corner model is also called DCTCE (Decentralized CTC and Exchange), as it’s handling both the exchange of invoices between participants, and the e-reporting to the tax authority (CTC).

Tip: pause the animation below by putting your mouse or finger on the image

This model is gaining increasing traction as more countries introduce e-reporting mandates, finding the 5-corner model to be a convenient and scalable solution for meeting these new requirements, and enabling companies to do the same.

Peppol CTC Network

The Peppol network serves as the most prominent example of a 5-corner model within the context of national e-invoicing and e-reporting mandates, commonly referred to as the Peppol CTC network. Here, tax authorities assume the role of the 5th corner, receiving in real-time all CTC data.

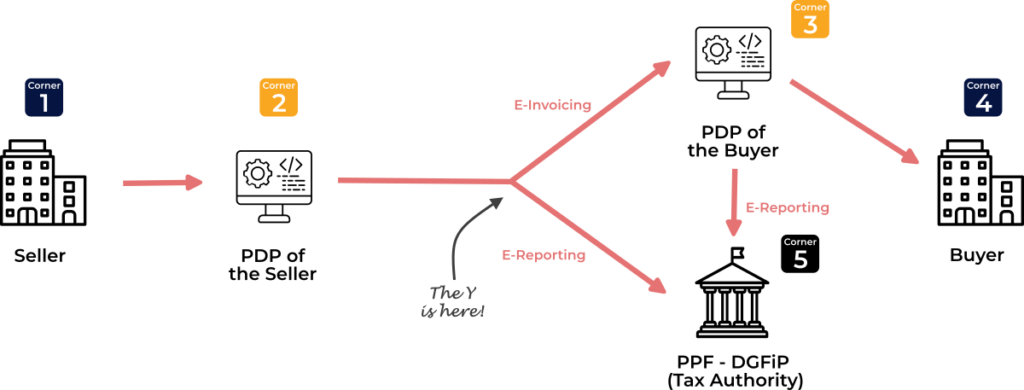

Y-Model

Building on the approach that has been in place in Mexico for many years, France has developed an advanced e-invoicing system based on a 5-corner model (a 4-corner network plus the tax authority for e-reporting). This system was also designed to function as a 3-corner model using the government’s central platform, but this option has been removed from France’s final Y-model.

In France’s “Y-model”, businesses use certified service providers known as “PDP” (Partner Dematerialization Platforms) for e-invoicing and the government’s central platform, “PPF” for e-reporting.

PDPs can establish direct point-to-point connections with other PDPs or connect through a broader 4-corner network like Peppol, while transmitting tax data (CTC) to the tax authority (the 5th corner).

Although the Y-Model may appear complex, it offers significant flexibility to companies. Businesses can choose any PDP that best meets their needs, benefiting from additional services such as processing invoices in different invoice formats.

This model is expected to set a precedent, with Spain already announcing plans to adopt a similar Y-model for its upcoming B2B e-invoicing mandate.

The Invoicing Hub Word

Decentralized Networks Are the Future of Business Communication

It is useful to understand the fundamental characteristics of any communication model used in business document exchanges, as each have their own benefits and drawbacks. In particular, assessing the pros and cons of a given architecture is simpler using these categories.

In a modern, inter-connected world, the simplistic approach of “direct connectivity” seems beneficial but turns out limiting in terms of scalability as the complexity of managing dependencies grow.

While employing an indirect model would solve many of the challenges, the dependency on a single hub in a central model quickly becomes prohibitive for long-term adoption as well as global reach.

To meet these demands, more decentralized models like the 4-corner and 5-corner frameworks are necessary. Ensuring interoperability between the components of the communication architecture is crucial for delivering value. Present and future compliance requirements will inevitably highlight these models anyway, driving more companies to adopt them.

Realistically, each business is going to have to participate in multiple communications channels and therefore network models at the same time. Implementing access or choosing a strong partner to connect is an effective strategy to keep the overhead under control.

Get your Project Implemented

Gold Sponsor

With expert technical support and tailored consulting, we help global and local companies meet Mexico’s invoicing mandates with ease and efficiency. Whether you're operating in Mexico or need to invoice Mexican partners, we ensure full compliance and operational continuity.

Webinar – Belgium’s E-Invoicing Shift Is Coming: Are You Ready?

KSeF 2.0 and FA(3) finalized: time for businesses to start implementation

Start of voluntary e-reporting in Singapore

Webinar — France’s E-Invoicing Revolution: are you ready for the compliance storm?

Webinar – Cracking the Code of Germany’s E-Invoicing Mandate

The Invoicing Hub

experts can help you

Strategy, Guidance, Training, …

![[1/4] - Two trading partners, a Seller and a Buyer, wish to establish a connection to exchange invoices. They are integral to a broader economy that includes many other companies.](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/2-corner-3.png)

![[2/4] - They may also have setup more point-to-point connections with other companies that they are trading with ...](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/2-corner-4-1.png)

![[3/4] - ... who themselves may also be connected via EDI to some of their own trading partners.](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/2-corner-5-1.png)

![[4/4] - Some companies are not equipped with EDI solutions and are not directly connected to other companies. The few equipped companies are connected to a relatively limited number of trading partners.](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/2-corner-6-1.png)

![[1/4] - Two trading partners, a Seller and a Buyer, wish to establish a connection to exchange invoices. They are integral to a broader economy that includes many other companies.](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/3-corner-1.png)

![[2/4] - Ultimately, they decide to involve a third party. The choice can either be voluntary (to take advantage of the added value brought by a service provider) or due to legal requirements (an e-invoicing mandate requiring them to send invoices through a central government platform).](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/3-corner-2.png)

![[3/4] - Many other companies are also connected to this third party, making trade between all participants easier through the use of standardized practices.](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/3-corner-3.png)

![[4/4] - Some companies are not connected to this third party, either because they use a different service provider or because they are based abroad and are not required to use their trading partner's government central platform.](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/3-corner-4-1.png)

![[1/6] - Two trading partners, a Seller and a Buyer, wish to establish a connection to exchange invoices. They are integral to a broader economy that includes many other companies.](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/4-corner-1-1.png)

![[2/6] - Each company selects its own service provider to meet their needs, with these providers acting as "Access Points" in a 4-corner model.](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/4-corner-2-1.png)

![[3/6] - Through the 4-corner network, the Seller (Corner 1) sends an invoice to the Buyer (Corner 4) via their respective Access Points, as the Seller's Access Point (Corner 2) relays it to the Buyer's Access Point (Corner 3).](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/4-corner-3-2.png)

![[4/6] - The interconnected service providers are the Access Points of the 4-corner Decentralized Network.](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/4-corner-4-2.png)

![[5/6] - Together, the Access Points connect a vast number of businesses, linking their invoicing processes.](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/4-corner-5-1.png)

![[6/6] - All Access Points are interconnected through the "Connect Once, Connect to All" principle, allowing Sellers to effortlessly send invoices to any Buyer in the network.](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/4-corner-6-1.png)

![[1/2] - The 5-corner model is a variation of the 4-corner model. In the 4-corner model, the Seller (Corner 1) sends an invoice to the Buyer (Corner 4) via their respective Access Points, as the Seller's Access Point (Corner 2) relays it to the Buyer's Access Point (Corner 3).](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/5-corner-2-1.png)

![[2/2] - In a 5-corner model, a Tax Authority acts as the 5th corner, receiving CTC (Continuous Transaction Controls) data from all Access Points. This data is used to facilitate tax reporting and prevent tax fraud.](https://www.theinvoicinghub.com/wp-content/uploads/2024/09/5-corner-3-1.png)