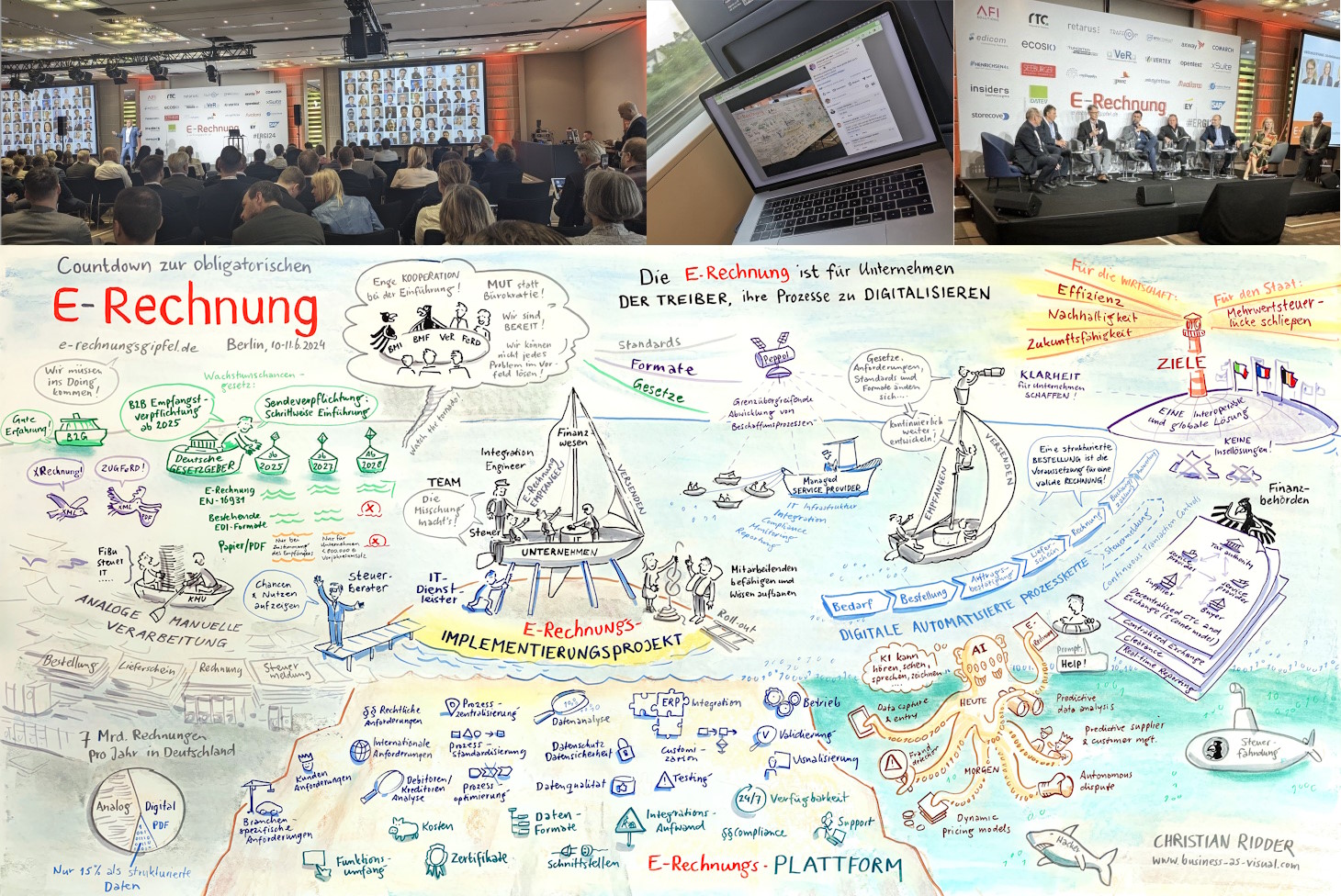

General sentiment among the many participants of the eRechnungsgipfel (“E-Invoicing Summit”) focused on the short remaining time until 1.1.2025 when the obligation to use electronic, structured invoices starts, leaving only transition periods for certain aspects until full scope takes effect on 1.1.2028.

Huge gaps of awareness among SMEs and tax accountants

The most prominent conclusion is that general knowledge about the new regulations is quite low outside of the “bubble” of the e-Invoicing community and larger corporations. This is particularly true in the more than 3 million small and medium businesses as became evident in preliminary results of a scientific survey (still open to answers) conducted by Quirin Jackl and Annalina Landsberg from University in Erlangen-Nürnberg.

A bit more surprising though are the gaps also found in the tax accounting community as evidenced in informal anecdotes shared on stage and in conversations. There clearly is a lot of work left for the associations to spread information and train their members, who play a particularly important role as multipliers with the SMEs.

Preparations for 1.1.2025 in full swing

The upcoming transition period was compared to air traffic: businesses required to accept invoices are in a similar situation as if building runways for future aircraft to land on.

“It’s like building runways preparing for aircraft to arrive”

Alexander Kollmann, Schwarz Gruppe

The runway features are defined by the European Norm 16931 to be used by those aircraft. Those “aircraft” invoices are going to start arriving depending on the implementations on the suppliers’ side anytime up until 1.1.2028

On a practical level, while tempting and in wide-spread use for its simplicity and omni-presence, the deficiencies of using plain E-Mail for invoice delivery were noted, culminating in the clear prediction on open stage:

“E-Mail in the context of e-Invoicing has an expiration date”

Richard Luthard, VeR and DATEV eG

referring to the lack of authenticity, confidentiality as well as the need to address the risk of fraudulent phishing invoices. This combination poses a yet unreached threat level in the business context.

Beyond e-invoicing: consider e-ordering

Raising the eyes beyond immediate implementation, the impact of digitizing the entire process chain was highlighted: current practical experience already indicates that “a structured order is the best prerequisite for a valid electronic invoice” (Mike Hoffmann, Würth)

We are well on our way

In summary, the time is now to start actual implementations. Considering the many contributing factors also from beyond our German borders we’ll need to “watch the tornado” (Marcus Laube, billentis).

Speakers repeatedly noted that collaboration with the public administration and particularly the Ministry of Finance is useful, open and constructive, giving raise to the expectation of a solid and pragmatic transition process.

All in all, “Land is in sight” as depicted in the official artistic rendition of the e-Rechnungsgipfel: the e-Invoicing Platform is the bedrock of the implementation island, from which we set sail towards the interoperable and global solution in the European context!

The complete agenda is still available on the event website. And as announced previously, the next eRechnungsgipfel will take place in Berlin on October 21 & 22, and registration is still ongoing.