E-Invoicing in Finland

Last update: 2024, June 5

Summary

B2G

Mandatory

Mandatory for all B2G transactions since 2019-2020, with the only requirement that e-invoices must be EN16931-compliant.

B2B

Allowed

E-invoicing is allowed, and companies using e-invoicing must comply with the EN 16931. Additionally, any company with a 10,000€+ turnover can request its suppliers to send e-invoices.

What the Law Says

B2G E-Invoicing

After being one of the first countries to use Peppol (from 2008!), Finland implemented a B2G e-invoicing mandate, making it mandatory to use e-invoices first only with central public administrations in 2019, then extending to all B2G transactions (with any public administration) in 2021.

Additionally, since 2021, all B2G e-invoices must comply with the European Norm (EN) 16931, but exceptions can be There is a variety of options available, such as the local Finvoice 3.0 and TEAPPSXML 3.0 formats that are widely used in Finland or the Peppol BIS 3.0 format that is gaining more and more traction.

On the other hand, there is no requirement regarding an e-invoicing platform or an invoice transmission method.

Invoices must usually be archived for 6 years from the end of the accounting year.

B2B E-Invoicing

There is no official B2B e-invoicing mandate in Finland, which means that invoices can be transmitted using paper, PDF with an e-signature (or a complete business audit trail) or EDI.

However, since 2021, a new law was passed, stating that any business with an annual turnover of more than 10,000 € may require its suppliers to send electronic invoices.

The format requirements are identical to B2G transactions: B2B e-invoices must be EN-16931 compliant. Hence, Finvoice 3.0, TEAPPSXML 3.0 and Peppol BIS 3.0 are the most popular formats in Finland. Similarly, there is no platform requirements so companies are free to elect the solution of their choice.

Invoices must usually be archived for 6 years from the end of the accounting year.

Timeline

B2G E-Invoicing mandate - Central administrations

B2G E-Invoicing mandate - All administrations

E-invoicing possible only if EN16931-compliant

Additionally, private companies with turnover >10,000€ can require their suppliers to issue e-invoices

Technical Details

Identification

There is no central platform in Finland for suppliers to send their invoices to public administrations or to private businesses. Rather, there are several portals depending on the organization to be invoiced.

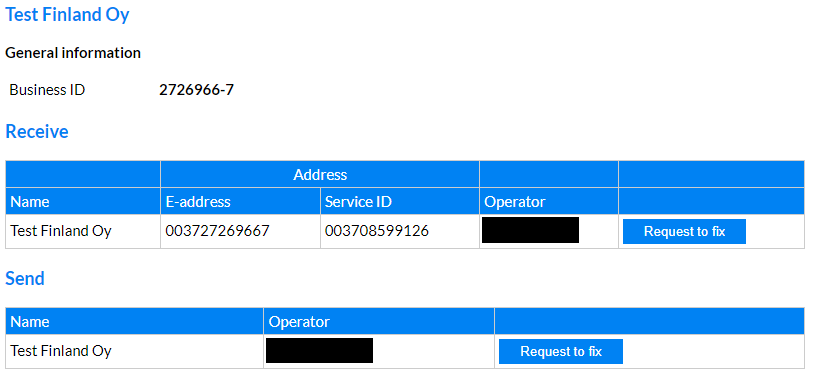

However, to facilitate the invoicing process in the country, the Verkkolaskuosoite online directory is available and collectively maintained. It lists 300,000+ organizations (public & private) and which e-invoicing portal to use to reach them. The Verkkolaskuosoite online directory even gathers all information related to Finnish businesses available in the Peppol Directory, under supervision of the Valtiokonttori.

Suppliers can use this tool to find out valuable information about their customers:

- Their business identifiers: “E-address” and “Service ID” that they have to include into the content of their invoices

- The e-invoicing portal (“Operator”) that they have to submit their invoices to

Invoice Content & Format

E-invoicing has been in place for a long time in Finland, which has led to a number of formats in use all over the country.

In the cases where e-invoicing is mandatory (in the B2G context or if a buyer requires it in the B2B context), the electronic invoice content is required to comply to the European Norm (EN) 16931 (EU Directive 2014/55/EU).

Thus, the following e-invoice formats must be used:

- FInvoice 3.0 (specifications), a format used only in the Finnish bank network, where banks transmit e-invoices between bank customers

- TEAPPSXML 3.0 (specifications), a format in use for e-invoice exchanges between e-invoice operators

- Peppol BIS 3.0 (specifications)

Suppliers not equipped with an e-invoicing solution

Not all companies have e-invoicing capabilities, especially the smallest ones.

Such suppliers that need to send electronic invoices to public administrations can use portals where they can manually create e-invoices free of charge. For example, as advised by the Danish State Treasury in their “Invoice the state” guidelines, they can use the Handi supplier portal or the Basware supplier portal.

Similarly, for the B2B sphere, most e-invoicing providers often offer manual entry solutions to suppliers directly on their portal.

Beyond E-Invoicing: E-Ordering

Many companies and public administrations in Finland are already connected to the Peppol network, so the government moving forward on this topic is not a surprise.

Indeed, since April 1, 2024, e-ordering via Peppol will start being used in applicable public procurement contracts, and will gradually become the norm by 2026.

It means that suppliers of Finnish public administrations will have to be able to receive & process purchase orders via Peppol, as well as sending back order responses (via Peppol again) to the buyer.

And then, of course, the supplier must send an electronic invoice, as described in the previous sections.

The Invoicing Hub Word

Finland

Finland, along all the Nordics countries, has been a pioneer of e-invoicing in Europe and even in the world. Companies in Finland started using the Peppol network in 2008 and the government added an obligation for public administrations to use e-invoicing in 2019-2020.

Then, 2021 was the year where e-invoicing became mandatory for all B2G transactions.

2021 was also the year where Finland saw an even bigger news: any company with a turnover of more than 10,000 € can require its suppliers to send e-invoices. This is a massive change and a huge adoption driver, but it can be demanding on suppliers who are not e-invoicing-ready yet.

Fortunately, all these years of active e-invoicing promotion by the government led many Finnish companies to implement e-invoicing solutions, which makes Finland one of the most advanced countries in that domain.

And the story does not stop there as e-ordering is the next step with already a B2G mandate in effect since April 2024.

Additional Resources

Public entity supervising the e-invoicing mandates in Finland

Official guidelines on how to invoice public administrations

Peppol Authority in Finland

Official directory of Finnish businesses and how to invoice them

Finnish non-profit organization aiming to help businesses in their digital endeavours

E-invoicing & e-invoice address service guidelines

Finnish FInvoice 3.0 format specifications maintained by Finance Finland

Finnish TEAPPSXML 3.0 format specifications maintained by TietoEVRY

Entire set of official Peppol BIS 3.0 specifications

Get your Project Implemented

Gold Sponsor

Silver Sponsors

Advertisement

Latest News - Finland

OpenPeppol conference 2025 – Brussels, June 17-18

ViDA formally published

ViDA clears final step in European Council

EU Parliament approves latest ViDA updates

Next E-Invoicing Exchange Summit to take place in Dubai (Feb. 10-12, 2025)

The Invoicing Hub

experts can help you

Strategy, Guidance, Training, …