E-Invoicing in India

Last update: 2025, January 28

Summary

B2G

Partially mandatory

Clearance required for all B2B transactions through a central platform (IRP) for businesses with an annual turnover exceeding 5 crore (~0.55M€).

B2B

Partially mandatory

Clearance required for all B2B transactions through a central platform (IRP) for businesses with an annual turnover exceeding 5 crore (~0.55M€).

B2B

Voluntary

Pilot in progress overseen by the GST Council

What the Law Says

B2G & B2B E-Invoicing

India’s e-invoicing mandate affects all B2G and B2B transactions and has been rolled out in multiple phases based on annual company turnover.

Initially introduced in October 2020 for large businesses with an annual turnover exceeding 500 crore (~55 M€), the mandate has been gradually decreased and currently stands at its 5th phase, covering all businesses with a turnover above 5 crore (~550 K€) as of August 2023.

Currently, there are no plans to further lower the threshold, meaning that most small and medium-sized businesses (SMBs) remain unaffected and are unlikely to be impacted in the near future.

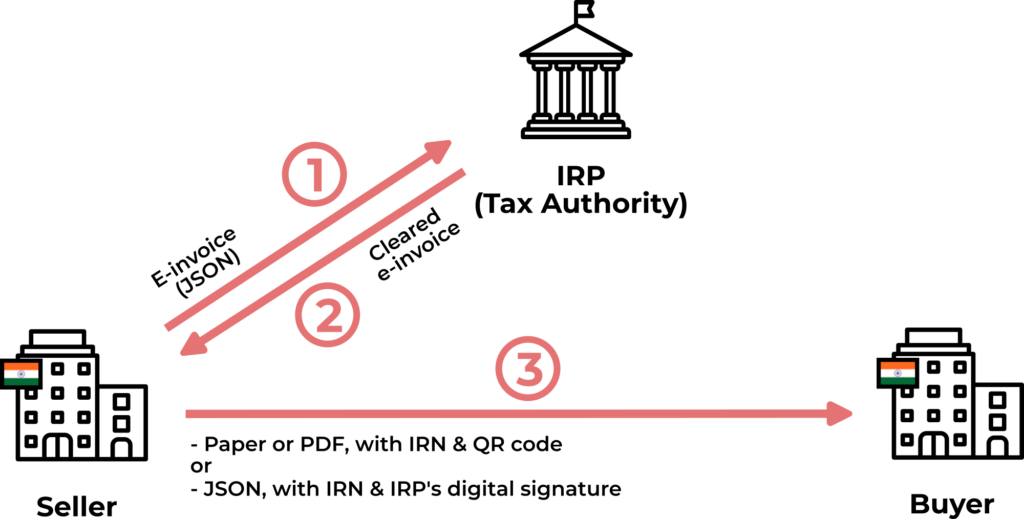

The mandate follows a “Clearance” model, requiring suppliers to submit their invoices in a proprietary JSON format to a central platform called Invoice Registration Portal (IRP). Once validated, the IRP provides an Invoice Reference Number (IRN) and a QR code that must be incorporated into the final invoice.

Suppliers are then responsible for delivering the invoice to their customers in their preferred format—whether paper, PDF, or electronic.

While the mandate applies broadly across the country, certain entities, such as government and local public bodies, as well as banks and financial institutions, are exempt. For complete and up-to-date information, businesses are advised to consult the official documentation provided by the Goods and Services Tax Network (GSTN) on the official GST portal.

B2C E-Invoicing

As of September 9, 2024, the GST Council has started a pilot program for B2C e-invoicing. The initiative aims to assess potential benefits in the retail sector, such as improved efficiency, cost savings, and environmental sustainability.

In its initial phase, participation in the pilot is voluntary and limited to specific states and industries.

A nationwide mandatory implementation may be considered based on the results and feedback from the pilot program.

Timeline

E-Invoicing Mandatory for Large Businesses

E-invoicing Mandate Threshold Reduced to 5 Crore

B2C E-Invoicing Pilot

B2G & B2B Technical Details

Invoice Clearance

India’s e-invoicing mandate, introduced by the Goods & Services Tax Council (GSTC), applies to most businesses engaged in B2G and B2B transactions with an annual turnover exceeding 5 crore (~550 K€).

The system follows a Clearance model, requiring businesses to first submit their invoices to the tax authority for validation. This process is carried out through a central platform known as the Invoice and Registration Portal (IRP).

Currently, there are six different IRPs available, allowing businesses to choose the one that best meets their needs. While all IRPs provide the essential clearance functionalities mandated by law at no cost, they also offer additional paid features.

Invoices must be submitted to the IRP in a proprietary JSON format specified by the GSTC.

Once an invoice is validated, the IRP generates a unique Invoice Reference Number (IRN) for easy tracking and identification. It also applies a digital signature to ensure authenticity and prevent tampering, and generates a QR code giving access to the invoice details. The invoice issuer can then retrieve all those elements from the IRP.

Furthermore, the IRP transmits the tax-relevant information to the tax authority and automatically populates invoice details in the tax return forms (such as the GSTR-1 or the GSTR-2A) required from businesses.

Invoice Delivery

As is typical in a standard Clearance model, the e-invoicing mandate does not regulate how invoices are delivered to recipients. Businesses are free to deliver invoices in any mutually agreed format, whether electronic or paper-based.

In most cases, companies opt for paper or PDF invoices, which must include the QR code and the unique IRN to allow recipients to verify the invoice’s authenticity.

Alternatively, businesses can choose to exchange electronic invoices by sharing the JSON file that has been validated by the IRP, complete with the assigned IRN and the IRP’s digital signature. This signature guarantees the integrity and authenticity of the e-invoice for the recipient.

The Invoicing Hub Word

India

India has rolled out its e-invoicing mandate in a phased manner, reflecting a strategic effort to digitize GST compliance. Starting with large enterprises in 2020, the mandate has gradually been extended to include always more businesses. This step-by-step approach has helped companies transition smoothly while minimizing operational disruptions.

Despite the progress, many businesses are however unlikely to fully leverage the key advantages of e-invoicing, such as process automation and reduced manual errors. Indeed, after clearance by the IRP, the majority of invoices will still be exchanged in paper or PDF format, requiring manual handling by recipients.

But in the world’s most populous country, the decision to adopt a clearance model makes practical sense, as it imposes fewer requirements and ensures wider compliance across businesses. Looking ahead, India’s e-invoicing landscape holds immense potential, with the upcoming B2C pilot expected to further highlight its benefits.

Additional Resources

Tax authority supervising e-invoicing in India

Official resources on the e-invoicing mandate in India

Direct access to the 6 IRPs currently available

Technical specifications of the JSON format necessary for invoice clearance

Get your Project Implemented

Gold Sponsor

Silver Sponsors

Advertisement

Latest News - India

OpenPeppol conference 2025 – Brussels, June 17-18

New Country Coverage: India

The Invoicing Hub

experts can help you

Strategy, Guidance, Training, …