E-Invoicing in Poland

Last update: 2025, April 14

Summary

B2G

Will become mandatory soon

E-Invoicing is currently accepted, as well as paper or PDF invoices.

E-Invoicing should become mandatory for B2G transactions in 2026 through the “KSeF” central platform using the “FA(3)” (XML) format, or the existing “PEF” platform, connected to Peppol, using the Peppol BIS 3.0 format.

B2B

Will become mandatory soon

E-Invoicing is currently accepted, as well as paper or PDF invoices.

E-Invoicing should become mandatory for B2B transactions in 2026 through the “KSeF” central platform using the “FA(3)” (XML) format.

What the Law Says

B2G E-Invoicing

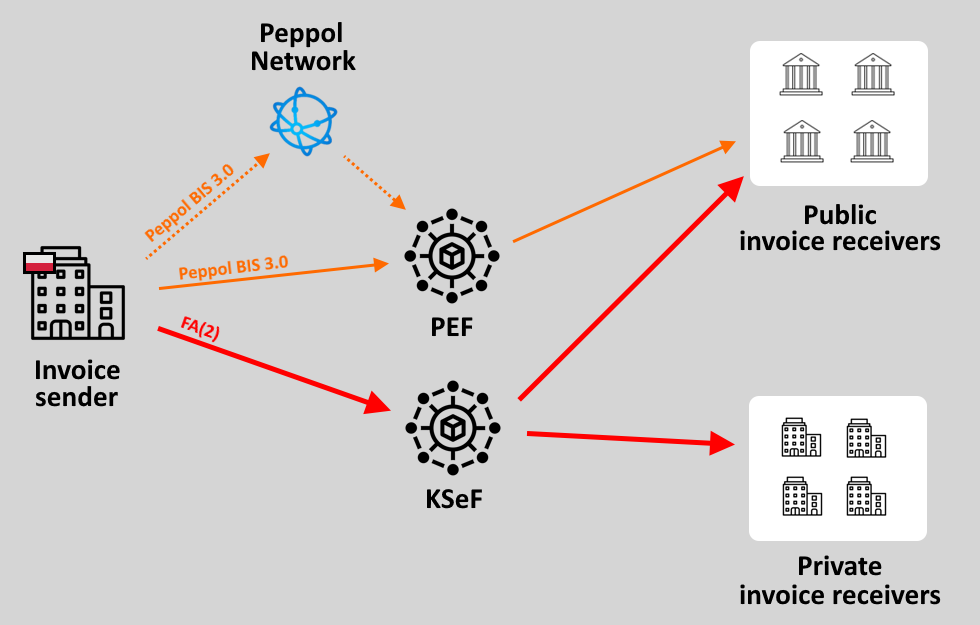

It is mandatory for all Polish public administrations to accept electronic invoices through the “PEF” central platform in plain PEPPOL BIS 3.0 UBL format or a Polish extended “Faktura specjalizowana” variant. The PEF platform is also connected directly to the Peppol network.

However, invoices can currently also be sent in paper or PDF format, as long as a complete audit trail is ensured.

Additionally, e-invoicing will become mandatory for all B2G transactions in Poland in 2026, following several delays. The roll-out will consist of 2 phases, depending on company annual turnover:

- February 1, 2026: mandatory for companies with an annual turnover > 200M PLN (~46M€)

- April 1, 2026: mandatory for all companies

Incidentally, a new central platform called “KSeF” (also directly connected to the Peppol network) is also available in addition to the PEF platform. All invoices going through the KSeF platform have to be issued in a new XML format called “FA(3)“.

It means that suppliers of the public administrations have the choice between the PEF platform in Peppol BIS 3.0 format or the KSeF platform in FA(3) format.

Invoices must be archived for 5 years in most cases.

B2B E-Invoicing

There is currently no B2B e-invoicing mandate in Poland, and as long as businesses ensure a complete invoice audit trail, they can exchange invoices in multiple ways

- Paper

- EDI

Everything will change in 2026, as electronic invoicing will then become mandatory for all B2B domestic transactions:

- Companies with an annual turnover above 200M PNL will have to comply from February 1, 2026

- All other companies will follow starting from April 1, 2026

E-Invoices will have to be sent in the XML “FA(3)” format through the new “KSeF” central platform and all other formats & transmission methods will not be accepted anymore. It is also not possible to use the PEF platform for B2B transactions.

There will also be a grace period until the end of 2026 where no sanctions will be issued, allowing more time to companies to fully comply with the mandate.

Finally, after some back & forth from the tax authority, it seems that B2C transactions will be possible via the KSeF platform, but not mandatory: paper or PDF will remain allowed for those.

Invoices must be archived for 5 years in most cases.

Timeline

B2G E-Invoicing - Mandatory Acceptance

B2G & B2B E-Invoicing Mandate - Large companies

B2G & B2B E-Invoicing Mandate - All companies

End of the B2B mandate grace period

Technical Details

B2B E-Invoicing

As of today, there is no requirement regarding the way to transmit invoices in Poland, which means they can be issued at will as:

- Paper-based invoices

- PDF invoices with e-signature or complete audit trail

- EDI invoices

Additionally, the tax authority is implementing a new platform called “KSeF” (Krajowy System e-Faktur), using a dedicated, Poland-specific “FA(3)” format. This format is based on XML, but it will most likely not comply with the EN 16931. The FA(3) format is an evolution of the already available FA(2) format, and is set to be released in Autumn 2024.

Upon successful submission of an e-invoice to the KSeF platform, the invoice issuer receives an official receipt called “UPO” from the platform.

B2G E-Invoicing

Regarding B2G transactions specifically, businesses can use either the KSeF platform or the “PEF” (Platformy Elektronicznego Fakturowania) central platform.

When opting for the PEF platform, suppliers have to send invoices in PEPPOL BIS 3.0 format (based on UBL XML) or using a BIS 3.0-UBL extension called “Faktura specjalizowana“, which adds specific fields for domestic Polish invoicing e.g. for Utility statements, addition gross data or supporting invoice factoring. All public administrations are required to accept e-invoices these ways.

The “PEF” platform is connected to the Peppol network, facilitating adoption and increasing interoperability particularly for cross-border invoices.

Upcoming B2B E-Invoicing Mandate

Then, in 2026, the country-wide e-invoicing mandate will become effective, both for B2G & B2B transactions. All B2B transactions will have to go through the KSeF platform, while B2G transactions will have to go through either the KSeF or the PEF platforms.

Outside the usual benefits of electronic invoicing (automation, efficiency, compliance, …), the Polish finance authorities offer specific incentives to increase usage of the KSeF platform specifically, such as:

- 10-years invoice archiving by the KSeF platform (businesses don’t need to archive the invoices themselves anymore)

- Automated invoice e-reporting to the tax authority (SAF-T process not necessary anymore)

- Tax incentives in some cases (for example quicker VAT refunds) until the e-invoicing mandate officially enters into force

The Invoicing Hub Word

Poland

Poland is currently facing significant VAT gaps, and mandatory e-invoicing will serve as a crucial tool in fighting this issue

Although the chosen model of one central platform “KSeF” (two if you count the legacy “PEF” B2G platform) and one standard format “FA(3)” makes the implementation of e-invoicing relatively straightforward for Polish companies, the language barrier can prove a challenge for multinational companies and for service providers wishing to offer e-invoicing services in Poland.

Fortunately, the interoperability between PEF platform and the Peppol network was definitely a key driver towards e-invoicing adoption and greatly facilitated the B2G mandate implementation. The KSeF platform may follow the same path of interoperability with the Peppol network – but this is not decided yet. In any case, this would greatly help to make sure the new country-wide mandate implementation is a success, particularly with cross-border invoices.

However, the fact that the FA(3) format will not comply with the European Norm 16931 raises questions, and may lead to future work in order to remain compliant with the European Directives on e-invoicing.

Additional Resources

Public entity supervising the e-invoicing mandate in Poland

Official guidelines & resources on the use of the KSeF central platform

Technical specifications for the KSeF central platform

Comprehensive FAQ about the upcoming KSeF requirements

Homepage of the PEF platform used for B2G transactions in Poland

Technical specifications of the Polish FA(2) format to be used on the KSeF central platform

Get your Project Implemented

Gold Sponsor

Powered by the world’s most sophisticated invoice-centric AI – trained on over 2 billion invoices – Basware's Intelligent Automation drives ROI by transforming finance operations. We serve 6,500+ customers globally and are trusted by industry leaders including DHL, Heineken and Sony. Fueled by 40 years of specialized expertise with $10+ trillion in total spend handled, we are pioneering the next era of finance.

With Basware, now it all just happens.

Silver Sponsors

Advertisement

Latest News - Poland

OpenPeppol conference 2025 – Brussels, June 17-18

ViDA formally published

ViDA clears final step in European Council

EU Parliament approves latest ViDA updates

Next E-Invoicing Exchange Summit to take place in Dubai (Feb. 10-12, 2025)

The Invoicing Hub

experts can help you

Strategy, Guidance, Training, …