E-Invoicing in Spain

Last update: 2025, December 16

Summary

B2G E-Invoicing

Mandatory

Via the Central platform “FACe” in FacturaE XML file format in most cases, but many exceptions exist due to the high level of autonomy of Spanish regions (e.g. Basque Country).

B2B E-Invoicing

Will become mandatory soon

Currently allowed, and a mandate is planned (probably around 2026 or 2027) but no clear timeline has been confirmed yet.

The upcoming mandate is set to follow the same principles than the French B2B one (5-corner model, private certified providers, invoice lifecycle, …)

Other mandates

Immediate Supply of Information (SII), already applicable: e-reporting mandatory for all transactions of large companies (>6M€ turnover)

VERI*FACTU, will be implemented in 2027: use of certified accounting software & invoice clearance mandatory for all companies not in the scope of SII

What the Law Says

B2G E-Invoicing

B2G e-invoicing has been mandatory in Spain since January 1, 2015. All suppliers to public entities are required to issue invoices electronically.

To facilitate things, one central platform called “FACe” is available, and companies should exchange invoices in the standardized “FacturaE” XML format, along with a digital signature. FACe also accepts the CIUS-SP format, an extension of the European Norm (EN) 16931.

However Spain, although not officially a federal country, still allows a lot of autonomy to its regions.

Consequently, the use of FACe & the Facturae file format is only mandatory for central administrations, not for local administrations. While all Spanish regions except Basque Country decided to also use FACe and the Facturae file format, some local administrations may not be reachable through FACe.

Additionally, the Basque Country decided to implement its own platform “Ticket BAI” and their own file format “TBAI”, also based on XML. And within the Basque Country itself, few things may also differ for each of its 3 provinces, such as the B2G mandate timeline.

Invoices must be archived for 6 years throughout Spain.

B2B E-Invoicing

No B2B mandate has been issued yet, but in September 2022, the law “Crea y Crece” (“create & grow”) was published, and it included B2B e-invoicing becoming mandatory country-wide.

A phased roll-out (large companies first, the rest one year later) was initially planned in 2024 and 2025, but the mandate was postponed. As the project is still in the legislative process, there is no timeline available yet, but it is expected to start in 2026 or 2027.

In the meantime, businesses can still transmit invoices in the following ways:

- Paper-based invoices

- PDF invoices with e-signature or complete audit trail

- EDI

SII (E-Reporting)

The Immediate Supply of Information (SII) mandate consists in reporting tax information of all transactions to the AEAT (Spain tax authority) within 4 calendar days.

It impacts mostly large companies, but not only:

- Large companies with a turnover > 6 M€

- Companies that are part of a VAT group

- Companies registered under REDEME (Monthly Refund Registry)

Smaller companies are not obligated to comply with e-reporting requirements but have the option to adopt the SII system voluntarily.

Businesses subject to the SII mandate must submit the relevant data to the AEAT using a proprietary XML format, or manually through an online portal.

A detailed documentation is available on the AEAT website.

VERI*FACTU (Certified Software)

In December 2023, an additional obligation was revealed within the Anti-Fraud law: the VERI*FACTU regulation. It will apply to all companies not currently subject to the Immediate Supply of Information (SII) system. Under this new mandate, businesses will be required to use certified accounting software (SIF).

Through the SIF, all invoices must be submitted to the AEAT (Spanish tax authority) in XML format before they can be delivered to their final recipient in any format (e.g., paper, PDF). Once validated, the AEAT will return a QR code that must be included on the invoice. This process effectively establishes a “clearance” model, as invoices must be approved before issuance.

A detailed documentation is available on the AEAT website, as well as online services.

Software providers must ensure their accounting solutions are certified by the AEAT by the end of July 2025, and all affected businesses must comply with VERI*FACTU requirements according to the following deadlines (which have already been postponed twice):

- January 1, 2027: Taxpayers subject to corporate income tax

- July 1, 2027: All other taxpayers

The VERI*FACTU mandate does not apply in the Basque country, where a similar system called TicketBAI is in place instead.

Timeline

B2G E-Invoicing Becomes Mandatory

B2G e-invoicing is mandatory for all companies sending invoices to public administrations using the FACe central platform and the FacturaE format.

Partially Mandatory E-Reporting

Large companies (>6M€) must report all transactions to the tax authority within 4 calendar days according to the "Immediate Supply of Information (SII)" mandate

B2B Central Platform Available

In addition to more traditional ways to exchange invoices (EDI, signed PDF, paper, ...), a central platform has been released by the Spanish government for B2B transactions.

Upcoming B2B E-Invoicing Mandate Annoucement

Law "Crea y Crece" published, introducing a phased roll-out of mandatory B2B e-invoicing, initially planned for 2024-2025

VERI*FACTU Becomes Mandatory for some companies

The use of certified accounting software & invoice clearance becomes mandatory for companies subject to corporate income tax and not impacted by the SII e-reporting mandate

VERI*FACTU Becomes Mandatory for all companies

The use of certified accounting software & invoice clearance becomes mandatory for all companies not impacted by the SII e-reporting mandate

B2B E-Invoicing Becomes Mandatory

Given that there's no clear timeline available yet, the B2B e-invoicing mandate is not likely to be implemented before 2025 at best

Latest E-Invoicing News in Spain

Webinar – European E-Invoicing Spotlight: Greece, Poland, Croatia & Spain

E-Invoicing named key enabler in EU’s Single Market Strategy

Technical Details (B2G)

In all Spanish regions beside the Basque Country, private businesses must use the central platform called “FACe” (Punto General de Entrada de Facturas Electrónica).

They have to send their invoices using the FacturaE format (based on XML) to the Spanish public administrations. Although FACe also accepts the CIUS-SP invoice syntax, an extension of the EN 16931, it is rarely used by companies.

Additionnally, the FacturaE e-invoices must be digitally signed using a XAdES signature.

Finally, each invoice must be properly addressed to the corresponding public entity (the invoice recipient) by specifying its DIR3 code. The DIR3 code can be found on the DIRe online directory and is a combination of 3 unique identifiers supervised by the Common Directory of Organizational Units and Office :

- The identifier of the Oficina Contable (Accounting Office)

- The identifier of the Órgano Gestor (Managing Office)

- The identifier of the Unidad Tramitadora (Processing Unit)

However, the use of FACe is mandatory for the central government and optional for regional and local administrations, which means that some public entities may not be reachable directly through FACe.

In that case, the invoice sender (the supplier of the public administration) should generally address the invoice to the “Administración General del Estado” (the central administration of the region) and specify the DIR3 code of the targetted local administration.

Upcoming B2B E-Invoicing Mandate

Upcoming Mandate Overview

Originally scheduled for implementation in 2024-2025 following the publication of the “Crea y Crece” law in September 2022, Spain’s upcoming B2B e-invoicing mandate is now unlikely to take effect before 2027 at the earliest.

The delay is primarily due to the pending publication of the corresponding royal decree, which will trigger the mandate’s implementation timeline:12 months for large companies and 24 months for small and medium enterprises (SMEs).

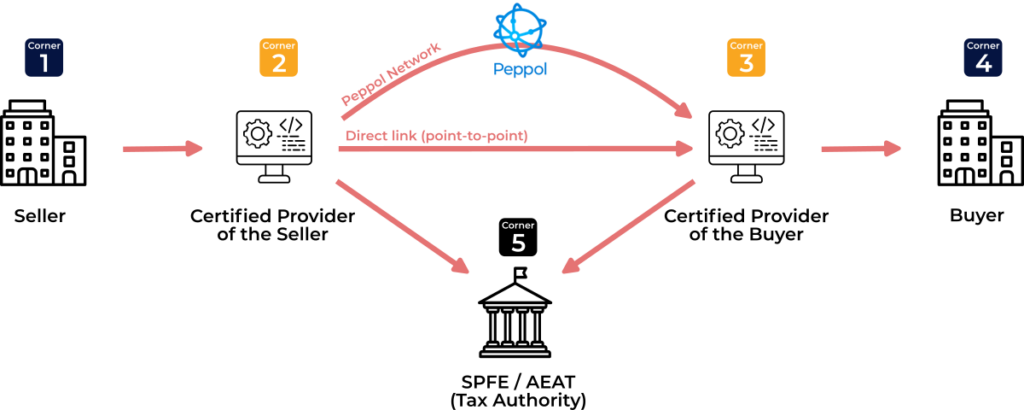

The AEAT (Spain tax authority) has proposed a model similar to the initial framework of the French B2B e-invoicing system, featuring a Y-Scheme structure. This includes a central platform SPFE (Solución Pública de Facturación Electrónica), optional use of certified service providers, and a framework requiring the mandatory exchange of invoice statuses between participants.

However, with France revising its approach in October 2024 and the ongoing lack of legislative progress in Spain, significant uncertainties remain. It is unclear whether the AEAT will follow France’s lead by limiting the SPFE’s role or stick with its original plan.

E-Invoicing Format & Delivery

In its current form, Spain’s upcoming B2B mandate is expected to require companies and certified service providers to exchange electronic invoices using the following formats:

- UBL (XML, compliant with EN 16931), as the mandate standard, will have to be used for all transmissions to the central platform

- FacturaE (XML, Spain’s national format)

- CII (XML, compliant with EN 16931)

- EDIFACT

The inclusion of these formats—especially EDIFACT, a widely adopted standard in various industries—will allow businesses already utilizing EDI systems to continue operating with minimal adjustments, provided their existing EDI service provider gets certified by the AEAT (Spanish tax authority).

Certified service providers will be responsible for enabling invoice exchanges between businesses while simultaneously transmitting the required data to the AEAT through the SPFE central platform.

Alternatively, businesses may have the option to exchange invoices directly through the SPFE platform, which will automatically extract and send the necessary tax data to the AEAT.

As for the existing FACeB2B platform, its future remains uncertain. It is unclear whether it will continue operating and if it will be integrated with the new SPFE central platform.

E-Invoice Statuses

Under this new mandate, the invoice recipient will have to provide updates to the invoice sender regarding the status of each invoice at two critical stages of its lifecycle through the use of invoice responses:

- Commercial acceptance or rejection of the invoice and the date of it

- Complete payment of the invoice and the date of it

Of course, these invoices statuses will also have to be sent to the AEAT that will be actively monitor payment data and track late-payers.

Basque Country

Given its extended autonomy, the Basque Country region did not follow the same timeline as the rest of the country and opted for a different solution to implement its B2G & B2B e-invoicing mandates.

There are many differences between what Spain did with FACe and what the Basque Country is currently implementing with its “TicketBAI” project.

The main characteristic of this project is that there is no central platform, rather a certified compliant software directly connected to the tax authority that must be used to issue compliant TicketBAI invoices.

This certified software is designed to issue the following documents:

- A TicketBAI XML file with all key elements about the invoice, which must be digitally signed using a XAdES signature and must contain proof of the invoice “chaining” (meaning that each XML has to identify the previous invoice to prove that there is no fraud)

- The invoice itself, either in paper or electronic format

- In both cases, the certified software must retrieve a unique TicketBAI invoice identifier to be applied on the invoice

- If the invoice is generated in a non-electronic format, the certified software must append a QR code onto the invoice that will give access to the data contained in the XML and its digital signature

Additionally, the Basque Country has chosen to implement an e-invoicing mandate that covers both B2G & B2B transactions at the same time, and the region is divided into 3 provinces, each with its own mandate implementation timeline: Álava (2022), Gipuzkoa (2022-2023) and Bizkaia (2024-2025).

The Invoicing Hub Word

Spain

Spain is a complex country regarding electronic invoicing, due to the federal nature of its administrations.

While most B2G transactions can be addressed via the central platform FACe, some local administrations are not reachable and create complications. Similarly, a whole region, the Basque Country, has opted for a different format and a different platform.

Moving on to B2B transactions, Spain will likely follow the French B2B mandate Y-model (or at least what it was supposed to look like before the announcement made in France in October 2024 about a reduced central platform scope) to give its regions and private businesses more flexibility by allowing B2B transactions either via a central platform or via certified service providers.

This model allows to share the load between the central platform and the certified service providers, and to allow the existing EDI connections to keep operating.

However, this adds significant complexity, making it challenging for companies to navigate the evolving regulatory landscape, and the Spanish government has not made things easier

It has indeed introduced additional obligations for smaller businesses through the VERI*FACTU law, and prolonged uncertainty by delaying the publication of the royal decree for the B2B e-invoicing mandate, with technical specifications still unavailable.

Additional Resources

Public entity supervising the e-invoicing mandates in Spain

Spain B2G central platform

Spain current B2B central platform

Official directory of Spanish businesses

List of private service providers officially verified by the FACe portal

Technical specifications of the FacturaE format

Technical specifications of the Veri*Factu law requirements

Web services and additional functionalities made available by AEAT for VERI*FACTU

Technical specifications of the SII (Immediate Supply of Information) law requirements

Get your Project Implemented

Gold Sponsor

With PA registration in France and readiness for Spain’s mandate, we support decentralized and reporting models with audit-ready status flows.

Our SaaS platform integrates natively with SAP ECC/S/4HANA and connects to other ERPs, orchestrating formats like UBL, CII, Factur-X and Facturae across 35+ countries.

Backed by 40 years of integration expertise, we turn evolving mandates into streamlined, data-first operations, improving control, speed, and cost from receipt to payment.

Silver Sponsors

Advertisement

Latest News

Sweden to assess implementation of domestic e-invoicing

Webinar – France’s digital leap: preparing for mandatory e‑invoicing in 2026

Staying ahead of global e-invoicing mandates in 2026

KSeF 2.0 launched on February 1, 2026 in Poland

E-invoicing webinar series to support businesses in New Zealand

📩 Newsletter

Receive the latest e-invoicing news, directly in your mailbox, once a month.