E-Invoicing in The Netherlands

Last update: 2024, November 4

Summary

B2G

Partially mandatory

E-invoicing is mandatory when dealing with central public administrations, and allowed with other public administrations.

There are several platforms & formats available, but the preferred method is via the Peppol network in Peppol BIS 3.0 format.

B2B

Not mandatory

E-Invoicing is allowed but there are no plans to make it mandatory in the near future

What the Law Says

B2G E-Invoicing

E-invoicing is allowed for all transactions with public administrations in The Netherlands since 2019. It is even mandatory to send electronic invoices for transactions involving central public administrations.

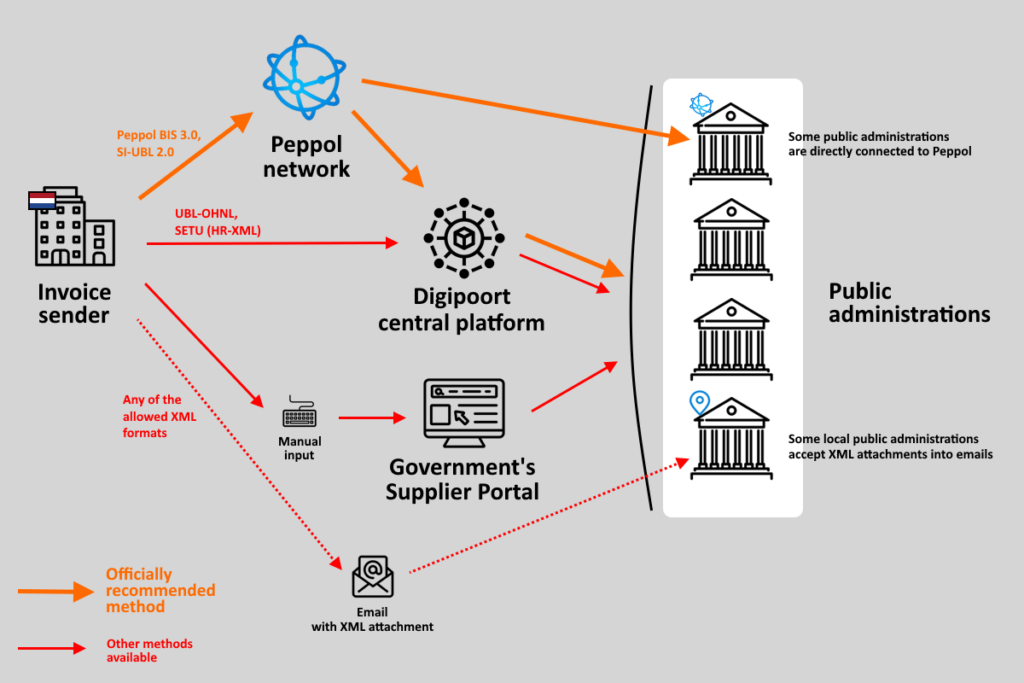

There are several ways to transmit an invoice to a public administrations in The Netherlands, and several formats also exist. However, as advised by the Dutch government and the Netherlands Peppol authority (NPa, formerly known as SimplerInvoicing), the preferred method revolves around the Peppol network and the Peppol BIS 3.0 format.

But there are other e-invoicing choices:

- a central platform called “Digipoort” that accepts UBL-OHNL and SETU (HR-XML) formats

- a central platform called the “Leveranciersportaal van de Rijksoverheid” (Government’s Supplier Portal) dedicated to manual submissions of invoices (manual input) in low volumes

- sending SI-UBL 2.0 invoices via the Peppol network

- some local public administrations also accept any of the above-mentioned formats attached to an email

B2B E-Invoicing

There is no B2B e-invoicing mandate in The Netherlands, and the government confirmed in 2023 that there is no plan to implement one in the future, given the low VAT fraud rate in the country.

Consequently, businesses can transmit B2B invoices in the following ways:

- Paper-based invoices

- PDF invoices with e-signature or complete audit trail

- EDI

Timeline

B2G E-Invoicing Mandate

E-invoicing is allowed for B2G transactions with local public administrations.

Peppol Becomes the Preferred E-Invoicing Method

Technical Details (B2G)

Peppol Network

The Dutch government promotes a clear preference: Peppol. It even took full ownership of all Peppol topics by creating the Netherlands Peppol authority (NPa), taking over from SimplerInvoicing, a foundation composed of e-invoicing service providers and financial software suppliers.

Consequently, the official recommendation for e-invoicing in The Netherlands is to use the Peppol network and to transmit invoices in Peppol BIS 3.0 format, which is compliant with the European Norm (EN) 16931.

Additionally, a second format of invoices can be used on the Peppol network: the local SI-UBL 2.0 format, which is also EN16931-compliant. Older versions of the SI-UBL format (such as SI-UBL 1.2) are not accepted anymore.

In the B2G context, invoices are addressed using the “Organization Identification Number (OIN)” as Peppol-ID; in B2B scenarios, the choice is to use the number assigned by the local chamber of commerce (Kamer van Koophandel, KVK) or the Dutch VAT-ID.

The Netherlands Peppol Authority (NPa) is quite strict in their supervision of the local Peppol Service providers, adding security (ISO 27001), End User Identification (EUI), specific transaction reporting and availability requirements on top of the Peppol ruleset. Their goal is to ensure choice of high-quality Peppol service providers serving the Dutch economic operators. In return, the NPA offers extensive support, documentation and a live NPa Peppol Test Tool.

Additional B2G Platforms

There is also a central platform called “Digipoort” that was built by the government. This platform only accepts 2 formats: the SETU (HR-XML) format dedicated to temporary hiring staff invoices, and the UBL-OHNL format for all other invoices types.

For information, the Digipoort platform is connected to the Peppol network. In most cases, when a supplier uses Peppol to send invoices to a Dutch public administration, the Peppol invoice is actually transmitted to Digipoort, converted to UBL-OHNL or SETU (HR-XML) format and then delivered to the public administration. Some public administrations however are directly connected to the Peppol network.

Another option available to suppliers with a low volume of B2G invoices (below ~50 per week) is to use yet another central platform: the “Leveranciersportaal van de Rijksoverheid” (Government’s Supplier Portal). This platform allows a supplier to manually input invoices without having to invest in a complete e-invoicing solution, but subsequently does not offer any automation capability.

Other Methods

Finally, some local public administrations will also accept invoices as XML attachments of an email. Any of the above-mentioned formats is allowed. This solution, while very easy to implement, is a last resort as it relies on manual processing and is prone to errors, and most public administrations will not accept it anyway.

B2G E-Invoicing Overview

Beyond E-Invoicing: E-Ordering

The government of The Netherlands has introduced in 2023 a pilot with the goal to facilite e-ordering & e-invoicing in the B2G sphere. This initiative is still on-going.

Through this pilot, the Dutch government gives on one side the tools to public administrations to enable e-ordering and easily issue e-orders, and on the other side the tools to suppliers of those public administrations to automatically convert e-orders into e-invoices.

This pilot aims to dramatically increase the speed of the whole accounting process for voluntary companies, make it error-free and lower its costs.

However, even though this pilot is just a first step, there is currently no further plan to extend this initiative or make e-ordering mandatory at some point.

The Invoicing Hub Word

The Netherlands

The Netherlands are strong advocates of the Peppol network for e-invoicing and have made it their official recommandation for all B2G transactions countrywide.

This recommandation is both welcome and very needed as the Dutch e-invoicing landscape is otherwise very complex as many formats & platforms coexist.

But after the B2G e-invoicing mandate, the Dutch government does not plan to move further with a B2B e-invoicing mandate due to the low VAT fraud rate in the country. This official position may unfortunately cause companies to miss out on the many benefits of electronic invoicing: higher productivity, lower costs, reduction of errors, …

However, having most businesses already equipped with Peppol capabilities will definitely drive many of them to e-invoicing also for their B2B transactions.

Additional Resources

Homepage of the Nederlandse Peppolautoriteit (NPa, ex-SimplerInvoicing)

E-invoicing guidelines published by Logius, the public entity in charge of Digipoort

E-invoicing helpdesk & guidelines

Official directory of worldwide Peppol-ready businesses

Entire set of official Peppol BIS 3.0 specifications

Specifications of SI-UBL, NL-CIUS, EN16931 invoice formats

Comprehensive Peppol test tool published by the NPa

Get your Project Implemented

Gold Sponsor

Silver Sponsors

Advertisement

Latest News - The Netherlands

OpenPeppol conference 2025 – Brussels, June 17-18

ViDA formally published

ViDA clears final step in European Council

EU Parliament approves latest ViDA updates

Next E-Invoicing Exchange Summit to take place in Dubai (Feb. 10-12, 2025)

The Invoicing Hub

experts can help you

Strategy, Guidance, Training, …