E-Invoicing in France

Last update: 2025, February 7

Summary

B2G

Mandatory

Mandatory via the central platform Chorus Pro, in UBL 2.1 or CII structured format, or Factur-X hybrid format.

B2B

Will become mandatory soon

Currently allowed using EDI, e-signature or guaranteeing a complete audit trail.

Gradually mandatory for domestic transactions in electronic format (2026-2027) via certified providers (PDP).

E-reporting will become gradually mandatory (2026-2027) via certified providers (PDP).

B2C

E-reporting will become mandatory soon

Allowed in any format (paper or electronic).

E-reporting will become gradually mandatory (2026-2027) via certified providers (PDP).

What the Law Says

B2G E-Invoicing

B2G e-invoicing has been mandatory in France since January 1, 2020. All suppliers to public entities are required to issue invoices electronically via the official and obligatory central platform Chorus Pro.

It will also be possible to send e-invoices to public administrations through certified providers (PDP) starting from 2026-2027, just like B2B e-invoicing.

B2B E-Invoicing & E-Reporting

The e-invoicing mandate in France will require all businesses to send and receive domestic B2B invoices electronically, in UBL, CII or Factur-X format (all 3 are EN16931-compliant).

It will also include an e-reporting obligation for VAT-based cross-border (i.e. mostly European) transactions.

The mandate will start in 2026, and will follow a phased roll-out:

- September 1st, 2026:

- Mandatory e-invoicing (sending & receiving) of domestic B2B transactions for medium- & large-sized companies (turnover > 50 M€ and/or employees > 250)

- Mandatory e-reporting of international B2B transactions for medium- & large-sized companies

- Mandatory acceptance (reception) of domestic B2B e-invoices issued by medium- & large-sized companies for all companies

- September 1st, 2027:

- Mandatory e-invoicing (sending & receiving) of domestic B2B transactions for all companies

- Mandatory e-reporting of international B2B transactions for all companies

According to the law, businesses will have to send and receive invoices through a certified provider (PDP). PDPs are private service providers that have been certified by the French government for their ability to offer e-invoicing capabilities in full compliance with the B2B mandate.

Prior to the mandatory implementation of this mandate, businesses can still transmit invoices in the following ways:

- Paper-based invoices

- PDF invoices with e-signature or complete audit trail

- EDI

B2C E-Reporting

In addition to the e-reporting of international B2B transactions, all B2C transactions will also have to be reported to the tax authority through a certified provider (PDP) under the same conditions, and following the same calendar:

- September 1st, 2026:

- Mandatory e-reporting of B2C transactions for medium- & large-sized companies (turnover > 50 M€ and/or employees > 250)

- September 1st, 2027:

- Mandatory e-reporting of B2C transactions for all companies

Timeline

B2G E-Invoicing Mandatory

B2B Mandate for Medium & Large companies

All businesses with mid or large suppliers must consequently also be able to receive e-invoices.

B2B Mandatory for All Companies

Technical Details (B2G)

All invoices to French Public Administrations must be submitted through the Chorus Pro central platform. The accepted formats are numerous, but mostly revolve around:

- UBL 2.1

- UN/CEFACT CII

- Hybrid PDF with structured XML (such as the Factur-X format, or a signed PDF with an XML embedded)

All these formats are compliant with the EN 16931.

Suppliers of public administrations that are not equipped with e-invoicing solutions can also manually input their invoices directly on Chorus Pro.

Comprehensive B2G specifications are available in the documentation section of the Chorus Pro portal.

While the Chorus Pro platform was initially supposed to be replaced by the Portail Public de Facturation (PPF) with the upcoming B2B e-invoicing mandate, DGFiP (French Tax Authority) announcements made at the end of 2024 have revealed other plans. Basically, the Chorus Pro platform should remain available but new connections to Chorus Pro could (and maybe should) then be implemented through certified providers (PDP), just like for B2B e-invoicing, following the same calendar.

Upcoming B2B E-Invoicing Mandate

Upcoming Mandate Overview

The upcoming B2B e-invoicing mandate in France is complex, as it consists of multiple components:

- PDPs (Partner Dematerialization Platforms): all businesses ine France will have to rely on PDPs, private service providers officially certified by the DGFiP (French tax authority) based on strict requirements, to exchange all the documents & data included in the mandate

- E-invoice delivery: All PDPs must be interoperable with each other. While direct point-to-point connections are possible, the only truly viable solution to meet this requirement is through the Peppol network.

- Invoice lifecycle: A structured framework for exchanging invoice statuses to ensure that all participants, including the tax authority, have continuous visibility into each invoice’s progress.

- E-reporting: The requirement to report all international B2B and B2C transactions to the tax authority.

- PPF: the central platform managed by the DGFiP, which will host the PDP central directory (“Annuaire”) and collect all necessary data for tax reporting.

Comprehensive yet incomplete specifications are available on the DGFiP website. The latest version (3.0) details interactions with the PPF and is noticeably shorter than the previous version (2.4), which also included PDP requirements and interactions.

As a result, although version 2.4 is outdated, it still contains crucial information regarding PDPs until an AFNOR (French standardization body) commission, appointed by the DGFiP, finalizes the PDP specifications. Additionally, the DGFiP is in the process of establishing a Peppol authority to clearly define PDP interactions and orchestrate the invoice lifecycle within the Peppol network.

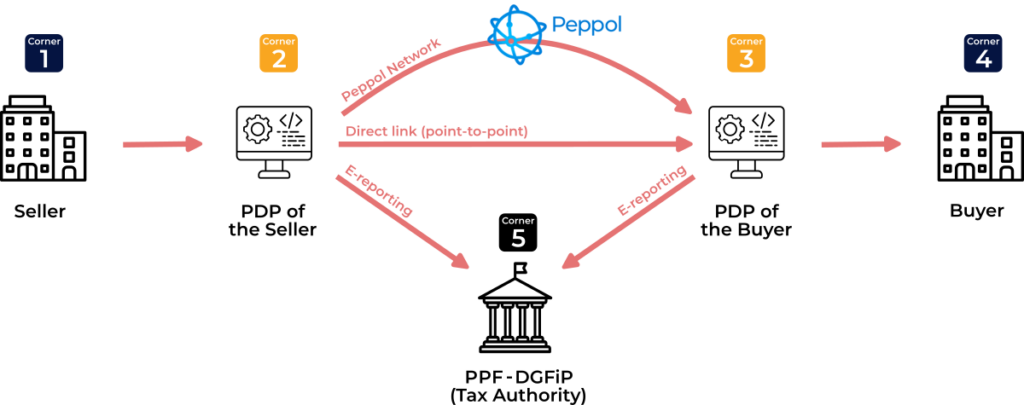

5-Corner Model

The upcoming B2B mandate will be implemented following a phased rollout planned for 2026 and 2027.

Initially structured as a “Y-Scheme,” the system featured a central platform (PPF – Portail Public de Facturation) and certified service providers (PDPs – Partner Dematerialization Platforms), allowing companies the choice of either option for submitting e-invoices and fulfilling e-reporting requirements.

However, in October 2024, it was announced that the PPF would no longer handle invoice processing and delivery, instead focusing solely on maintaining the central directory of companies (called “Annuaire”) and receiving tax data for e-reporting.

As a result, the B2B mandate will now adopt a standard 5-corner model, involving the following participants:

E-Invoice Routing Data

Invoice senders and recipients will be identified using their SIREN (national company identifier).

Furthermore, companies have the flexibility to work with multiple PDPs. For instance, they may choose different PDPs based on factors such as business location, business unit, subsidiary, or invoice type (e.g., direct or indirect purchases).

As a result, the SIREN alone is insufficient for the accurate routing of e-invoices. To address this, additional routing data must be included in the e-invoice. This routing information can be structured as either

- a combination of SIREN (mandatory) and a suffix code (free text) (optional)

- or a combination of SIREN (mandatory), SIRET (another national company identifier) (optional), and a routing code (free text) (optional)

All routing data will be accessible to PDPs (via API) and to businesses (via a web portal), within a central directory known as the “Annuaire,” hosted on the PPF platform.

Invoice senders have the option to either request the necessary routing data from their customers or retrieve it directly from the PPF Annuaire.

E-Invoice Format

3 formats are mandated by the government, and must be managed by all PDPs. All 3 are extensions of the European Norm (EN) 16931:

- UBL 2.1

- UN/CEFACT CII

- Factur-X (hybrid format with a readable PDF that includes an attached XML with the structured data)

Read our E-Invoicing Essentials article about the EN 16931 to find additional resources & specifications on this topic, and about EN 16931 extensions.

Both parties and their respective PDPs can mutually agree on any other electronic format, provided the necessary tax data for e-reporting can be extracted from it. This flexibility will enable companies to continue operating most of their existing EDI connections and to use the EDIFACT format, which remains widely used in various industries.

E-Invoice Delivery

PDPs have the flexibility to manage electronic invoice delivery as they see fit. Some may already have point-to-point EDI connections in place between themselves, which they can continue using or even expand by adding new such connections.

However, it is mandatory for all PDPs to be interconnected. To meet this requirement fully, only one solution is viable: a 4-corner model network, specifically through the Peppol network.

The Peppol network operates on a “Connect once, connect to all” principle, allowing any PDP connected to it to reach all other PDPs within the network. This ensures that PDPs can serve their customers effectively and that any seller can deliver e-invoices to any buyer.

As a result, the French government is collaborating with the OpenPeppol association to establish a Peppol Authority in France and in order to maximize the Peppol network capabilies in light of the upcoming mandate, and to publish the official specifications for all PDPs to follow.

E-Invoice Lifecycle

As part of the upcoming mandate, a complete invoice lifecycle has been defined and must be implemented by all PDPs to ensure that invoice senders, receivers, and the PPF always have visibility into the status of each invoice.

This invoice lifecycle consists of 14 different statuses, but only 4 of them are mandatory for exchange between participants:

- Status 200 – Submitted: This status indicates that the supplier has submitted a new invoice to the sending PDP (i.e., its own PDP), and that both the PPF and the invoice recipient will soon receive it.

- Status 210 – Refused: This status signifies that the invoice was rejected at the business level due to an issue such as an incorrect price or quantity, meaning the recipient has refused the invoice.

- Status 212 – Payment Received: Sent by the invoice issuer to the recipient (and the PPF), this status confirms that payment for the invoice has been successfully received, enhancing cash flow tracking and tax calculations for all stakeholders.

- Status 213 – Rejected: This status indicates that the invoice was automatically rejected by the receiving PDP due to a technical issue, such as invalid syntax or an incorrect recipient, following automated checks.

These four statuses alone do not provide a complete overview of the invoice processing journey. However, they do offer essential information, such as confirming an invoice’s existence (status 200), its successful completion (status 212), or its early termination due to an issue (statuses 210 & 213).

Although the invoice lifecycle is a promising concept, it presents significant challenges for PDPs in orchestrating these exchanges effectively. Moreover, the current official specifications do not yet fully address all aspects of the process.

As a result, the DGFiP has assigned an AFNOR (French standardization body) commission to draft official PDP specifications that comprehensively cover the entire invoice lifecycle process.

Upcoming B2B & B2C E-Reporting Mandate

Scope

The upcoming e-reporting mandate will cover all B2B and B2C transactions, taking effect on September 1, 2026, for mid-sized and large companies, and on September 1, 2027, for all other businesses—following the same timeline as the B2B e-invoicing mandate.

Domestic B2B invoices will not require any additional processing, as they will already need to be transmitted electronically via certified providers (PDPs) under the e-invoicing mandate. These PDPs will also automatically extract the necessary data for e-reporting and submit it to the PPF, which will forward it to the tax authority.

As a result, the e-reporting mandate will specifically apply to two types of transactions:

- International B2B invoices, particularly VAT-based transactions, meaning invoices exchanged by a French business with its European (primarily) trading partners

- B2C invoices

E-Reporting data & transmission

The e-reporting file format is a proprietary format relying on XML, been designed by the French tax authority, and is not based on any international standard.

It must be submitted to the tax authority via the PPF by the company’s PDP at a specified frequency—ranging from every 10 days to every 2 months—depending on the company’s VAT regime.

Within this e-reporting file, all international B2B transactions must be listed individually, while B2C transactions will be aggregated on a daily basis.

The Invoicing Hub Word

France

After implementing a central platform for B2G e-invoicing, France initially planned to introduce the Y-Scheme for its B2B mandate, incorporating both a central platform and certified providers.

However, due to time and budget constraints, the French government has significantly scaled back the project, deciding to rely exclusively on PDPs (Partner Dematerialization Platforms) for invoice processing and delivery. The PPF (Portail Public de Facturation) will focus primarily on the central directory of PDPs (“Annuaire”) and the e-reporting aspects of the mandate. As a result, the French mandate will ultimately follow a 5-corner model.

This shift has notable implications, particularly for many companies (especially smaller ones) and service providers that had initially planned to rely solely on the PPF. These businesses will now need to adjust their approach and select a PDP.

For some companies, this may result in additional costs, as the PPF was initially a free option, whereas most PDPs will likely charge for their services.

As a result, PDPs will play a central role in the upcoming B2B mandate, as their use will be mandatory. This will enable them to showcase their unique capabilities. Already, various types of PDPs are emerging, such as international e-invoicing providers targeting large companies, local French providers focusing on smaller businesses, accounting solutions, banks, etc.

However, many uncertainties still persist. Several critical topics, such as Peppol interoperability and invoice lifecycle management between PDPs, have yet to be addressed in the official specifications.

To address these gaps, the French tax authority (DGFiP) has assigned an AFNOR commission (the French standardization body) to finalize the PDP specifications, while the future French Peppol Authority will be responsible for defining the PDP interoperability framework.

With less than two years remaining before the mandate takes effect, deadlines are getting tighter, and everyone hopes there won’t be another postponement, and that PDPs and companies will be ready on time.

Additional Resources

Public entity supervising the e-invoicing mandates in France

Public entity in charge of technically enabling the e-invoicing mandates in France

France B2G central platform

Official list of resources about the upcoming B2B e-invoicing & e-reporting mandates

Official list of provisionally registered PDPs

Detailed documentation on how to implement the French B2G e-invoicing mandate

Detailed documentation on how to implement the upcoming French B2B e-invoicing & e-reporting mandates

Get your Project Implemented

Gold Sponsor

Founded in 1985, Esker operates in North America, Latin America, Europe and Asia Pacific.

Esker helps companies process e-invoices in compliance with the unique specifications of European countries. This includes processing any format (e.g., PDF, UBL, Facturae, Fattura-PA, etc.), communicating with PA platforms (including PEPPOL) to send e-invoices with status updates, and providing e-invoice archiving that’s compliant with regulatory frameworks.

Silver Sponsors

Advertisement

Latest News - France

OpenPeppol conference 2025 – Brussels, June 17-18

ViDA formally published

ViDA clears final step in European Council

EU Parliament approves latest ViDA updates

E-Invoicing & E-Reporting in France: The Complete Guide

The Invoicing Hub

experts can help you

Strategy, Guidance, Training, …