These registrations are occurring approximately two years ahead of France’s mandatory e-invoicing system implementation, currently planned for september 2026. This new mandate will require all businesses operating in France to issue their B2B invoices electronically, either via the government’s centralized Public Invoice Portal (PPF) or through certified PDPs.

PDPs to provide value-added services

PDPs are set to play a vital role in implementing this mandate. First, they will assist in distributing the processing load beyond the central PPF, ensuring smooth e-invoicing operations nationwide. To achieve this, PDPs must adhere to comprehensive specifications, released just before summer, covering various aspects such as platform security and functional scope.

In addition to meeting regulatory requirements, PDPs will offer businesses enhanced functionalities. These may include support for a broader range of invoice formats (like EDIFACT) not natively supported by the PPF, as well as various value-added services integrated into their solutions.

Insights on the current registration process

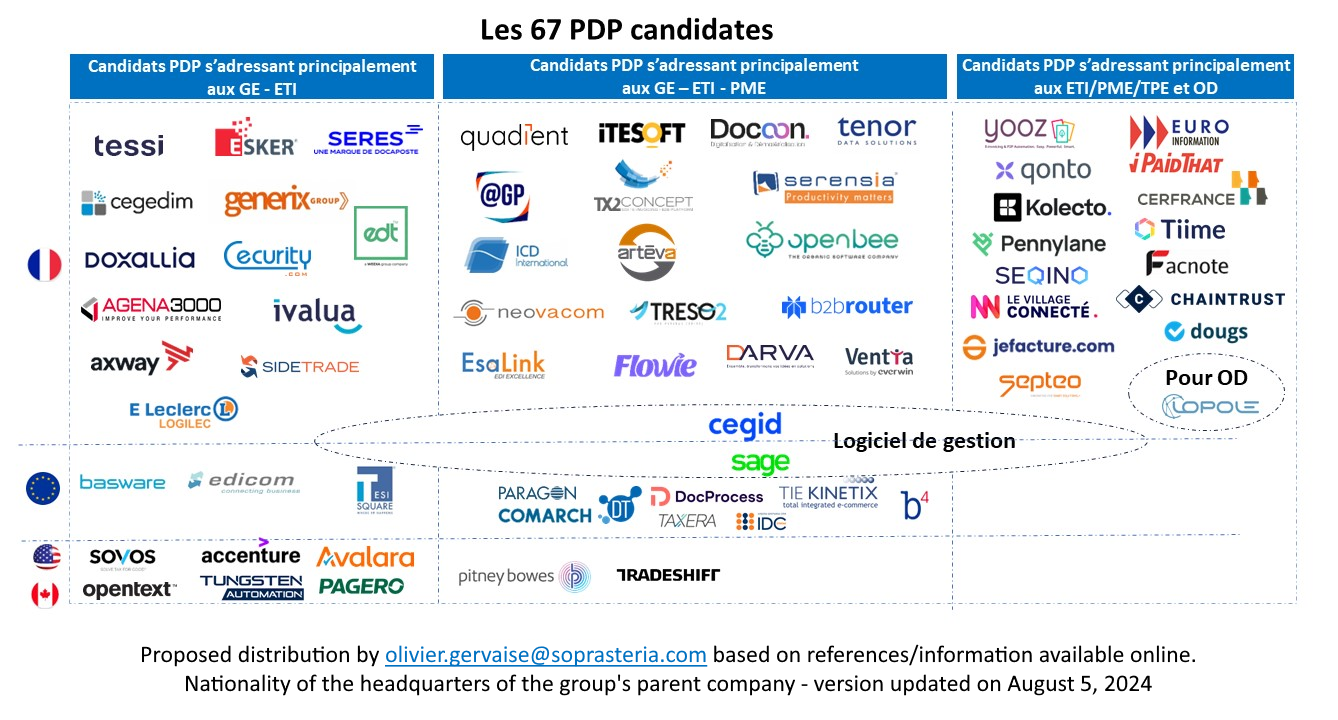

Currently, the DGFIP website lists about 70 service providers applying for PDP status. This includes all France’s sponsors of The Invoicing Hub: Tenor Data Solutions, Esker, IDC (Indicom), and Iopole.

PDP registrations began in early August 2024, with Pagero being the first officially announced platform. More service providers gained approval recently, one of them with the PDP registration number 0033, possibly indicating that 30+ PDPs have now received official certification.

This systematic numbering approach provides insight into the progress of the registration process, though the exact count of approved PDPs remains to be confirmed by authorities. Indeed, while the DGFIP has not yet made a formal announcement, it is expected in the coming weeks once all applications have been reviewed.

Learn more about France’s upcoming e-invoicing mandate in our comprehensive France Country Profile.

No comment yet, add your voice below!