Invoicing Terminology:

Semantics, Syntaxes, Formats, Standards, ...

Last update: 2024, October 14

Summary

Standards build a common understanding for compliance & interoperability. Versions track their evolution. A semantic model defines the meaning of data elements and their structure. File formats and syntaxes encode them into transmissible files.

By grasping these concepts, businesses can better navigate the complexities of e-invoicing and leverage its benefits.

Introduction

Electronic invoicing (e-invoicing), and more generally, electronic exchange of transactional documents, has had a huge impact on businesses, bringing efficiency, accuracy, and cost savings, but also new concepts, terminology and complexity.

To navigate this digital landscape, it is essential to understand common terms such as semantics, syntaxes, formats, standards, versions, …. This article aims to clarify these concepts, highlight their differences, and provide practical examples to help businesses effectively manage their e-invoicing processes.

Semantic Data Model

"What" Data Should Be Put into the Invoice?

Explanation

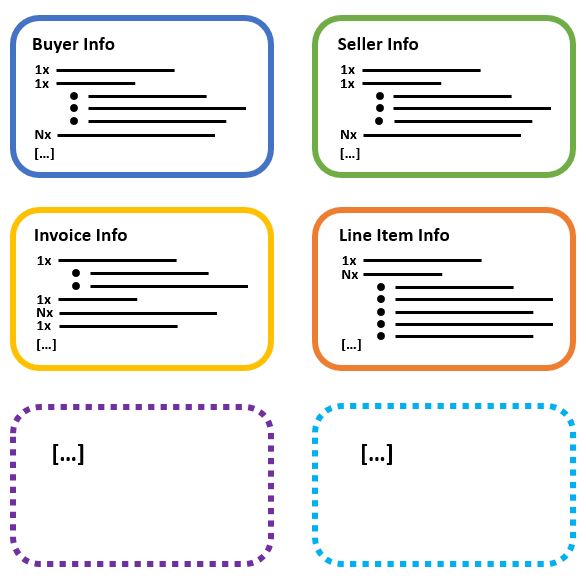

A semantic model defines the meaning and relationships of data elements within a specific domain. In e-invoicing, the semantic model describes the content of an invoice, more specifically its core components (e.g. the information about the buyer, seller, items, amounts) and how they relate to each other.

Examples

The semantic model of an invoice usually includes elements like:

- Buyer: The entity purchasing goods or services.

- Seller: The entity providing goods or services.

- Item: Each product or service listed on the invoice.

- Amount: The monetary value associated with each item.

An invoice consists of multiple such elements arranged in a logical structure. The model therefore collects basic information elements (like a street name or an item price) into groups representing a buyer’s address or an invoice line item.

These elements and their arrangement are defined independently of any specific data format or technology, ensuring consistent understanding across different systems.

Invoice Syntax

"How" to Incorporate the Data into the Invoice?

Explanation

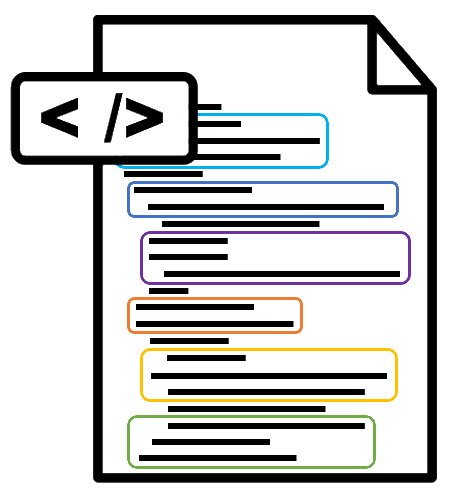

Once the “what” is established, the syntax addresses the question of “how” to write it down. Syntax refers to the specific rules and file formats for expressing the content of an invoice as an actual document. This includes:

- Data Placement: Where each piece of information should appear on the invoice. For example, the buyer’s postal address may need to be placed in a designated section.

- Formatting: The way information is presented, including characters to separate fields, date formats, currency symbols, and decimal separators.

- Document Structure: The overall layout of the invoice, including how to arrange data fields into headers, footers, and sections like line items.

Invoice syntaxes provide guidelines for structuring data according to different requirements or preferences. They ensure that invoices are consistently formatted and easy to read, facilitating accurate and automatic processing and compliance.

Examples

There are numerous invoice syntaxes and their different versions. Some of the most notable ones include:

- EDIFACT INVOIC D96A: Widely used syntax in the automotive, pharmaceutical, retail and supply chain industries, mostly in Europe. D96A is a version issued in 1996 of the EDIFACT INVOIC syntax.

- X12 810: A popular invoice syntax used in the USA

- Peppol BIS Billing 3.0 Invoice: developed by the European Union for the Peppol network and based on UBL, it is extensively adopted for cross-border transactions and numerous national e-invoicing initiatives in Europe and the APAC region

Standards

Sets of Syntaxes

Explanation

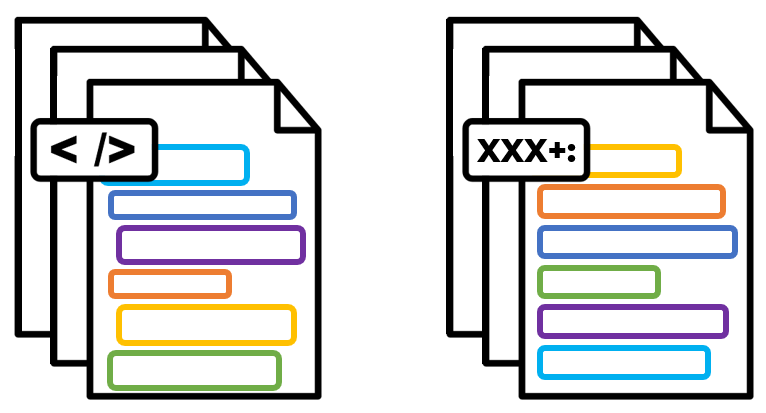

Standards provide a set of agreed-upon rules and practices, and are developed by various organizations. They include multiple invoice syntaxes, but are often broader as they also include syntaxes for other document types, such as purchase orders and remittance advices.

- Standards Organizations: Various organizations, such as ISO and national standards bodies, develop and maintain standards. They are responsible for creating, updating, and releasing new versions of these standards (and the corresponding syntaxes) to incorporate improvements and adapt to changing requirements.

- Public Norms: Some standards are regulated by public entities and have achieved formal normative status. For example, the European Norm 16931 is a widely recognized standard that defines specific syntaxes for generating invoices, ensuring consistency and compliance across different jurisdictions.

Examples

EDIFACT and X12 are standards that have been developed by organizations in order to promote EDI and business automation. They encompass a wide range of message types, such as purchase orders and shipping notices, in order to cover multiple aspects of business communication. Specifically, EDIFACT INVOIC and X12 810 are focused on invoicing.

The European Norm (EN) 16931 is a series of norms and specifications for e-invoicing across Europe that outlines the essential components of an electronic invoice. It can be implemented using syntaxes such as the UBL 2.1 Invoice Message and the UN/CEFACT CII (Cross Industry Invoice). Compliance with EN 16931 is required for B2G e-invoicing in all European countries, as mandated by Directive 2014/55/EU.

CIUS (Core Invoice Usage Specification)

Variations of the EN 16931

Explanation

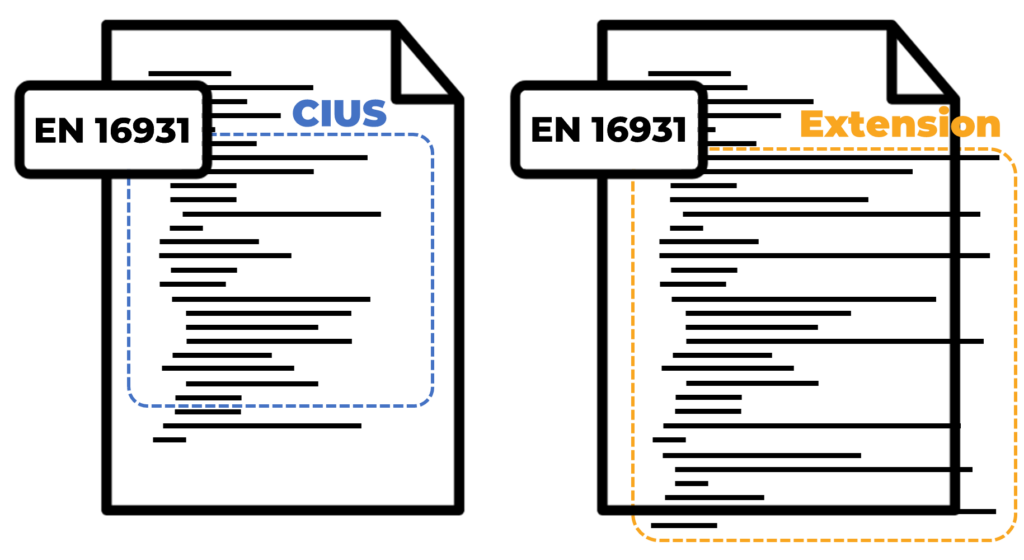

CIUS is a new concept introduced by the EN 16931.

While the EN 16931 provides a generic core framework for e-invoicing, CIUS address the need for country or business specific adaptations, in order to accommodate regional regulations or unique business requirements.

Essentially, a CIUS further limits the EN 16931 standard by defining more elements to be mandatory or which remain optional, and how certain data should be formatted or processed. This customization further restricts options and therefore enables more precise application of e-invoicing practices within a particular context, such as a specific country or industry, while remaining fully compliant with the core principles of EN 16931.

On the other hand, the EN 16931 has also introduced the concept of Extensions: variations of the EN 16931 that expand its scope. Extensions include the core data required by EN 16931, along with additional data to address specific local or industry needs. As a result, such extended invoices are considered conformant only, but not compliant, to the EN 16931.

Examples

Examples of CIUS, which, by definition, are compliant with the EN 16931:

- The cross-border Peppol BIS 3.0 invoice syntax, used on the Peppol Network

- The Portuguese “CIUS-PT” used in the national B2G e-invoicing mandate context

- The hybrid PDF/XML formats ZuGFeRD (Germany) and Factur-X (France)

Invoice Format

The Catch-All Term

Explanation

All the terms described above are clearly defined:

- The semantic data model defines “what” data needs to be included on an invoice

- The syntax dictates “how” this data should be presented

- Standards ensure consistency and compliance

- CIUS and Extensions offer customizations of the EN 16931

Then comes the term “format,” which is somewhat of a catch-all term, often used to refer to any of the concepts mentioned above. For instance, you might encounter instances, whether written or spoken, such as “EN 16931 format” or “EDIFACT format.” While this usage is not be entirely accurate, it is contextually understandable.

“Format” is frequently employed for simplicity, as it is easier for general use compared to more technical terms such as “syntaxes” or “CIUS,” which are primarily used by industry professionals. “Format” is often used to broadly describe the overall layout of an invoice: how its content is organized, “formatted”.

The Invoicing Hub Word

Master key terminology to successfully navigate the e-invoicing space.

Understanding invoice terminology can prove important to businesses ensuring clear communication and compliance with regulatory standards. Invoices are not just simple billing documents; they contain essential details that must align with legal and industry requirements.

Familiarity with terms like “syntax,” “CIUS,” and “format” helps businesses accurately interpret and manage the invoicing process, reducing the risk of errors that could lead to payment delays or legal complications.

Additionally, businesses can seek assistance from their service providers to navigate the complexities of the e-invoicing landscape and rely on trustworthy sources of information, such as The Invoicing Hub.

Get your Project Implemented

Gold Sponsor

Together with our technology partners (Coupa, Kofax, Microsoft) and our own platform Routty, we deliver innovative solutions for source-to-pay, purchase-to-pay, contracts, vendor management, document processing, e-invoicing, analytics, and reporting. Our solutions compliment the ERP-system, improving functionality and collaboration for both internal and external stakeholders.

OpenPeppol conference 2025 – Brussels, June 17-18

E-Rechnungs-Gipfel Berlin – June 23-25, 2025

B2G e-Invoicing now mandatory in Rheinland-Pfalz

[UPDATED] New OIOUBL 3.0 invoice standard released in Denmark

Peppol registration considered as automatic agreement for international e-invoicing in Belgium

The Invoicing Hub

experts can help you

Strategy, Guidance, Training, …