E-Invoicing in Italy

Last update: 2024, October 16

Summary

B2G

Mandatory

All invoices (B2B & B2G) must be transmitted through the central platform Sistema di Interscambio (SDI) in a standard format (FatturaPA)

B2B

Mandatory

All invoices (B2B & B2G) must be transmitted through the central platform Sistema di Interscambio (SDI) in a standard format (FatturaPA)

What the Law Says

E-Invoicing (B2G & B2B)

Italy is a very straightforward country in the world of e-invoicing: it is mandatory to use electronic invoices, country-wide, for all B2G, B2B and even B2C transactions!

Some exceptions of course still persist (for example for small enterprises with a low turnover), but there is a very limited number of them and they will progressively be included within the mandates scope.

The mandatory e-invoicing journey in Italy started in 2015 with B2G transactions, and was extended in 2019 to B2B & B2C.

It revolves around a central platform called Sistema di Interscambio (SDI) through which all invoices must flow. The e-invoice format is a standardized XML named FatturaPA. The SDI also accepts the CIUS-IT format, called “FatturaEU“, compliant with the European Norm (EN) 16931.

E-Reporting

E-reporting is also mandatory in Italy for all transactions in Italy. It is done automatically through the SDI central platform when transmitting the invoices in the context of the e-invoicing mandate.

Additionally, e-reporting is also mandatory for cross-border transactions, and it is the Italian company’s responsibility to also report those transactions electronically through the SDI central platform, again in FatturaPA or FatturaEU format.

Timeline

B2G E-Invoicing Mandatory

E-Invoicing & E-Reporting Mandatory

Cross-Border E-Reporting Mandatory

This method disappears and cross-border invoices must now be sent to the SDI too.

Technical Details

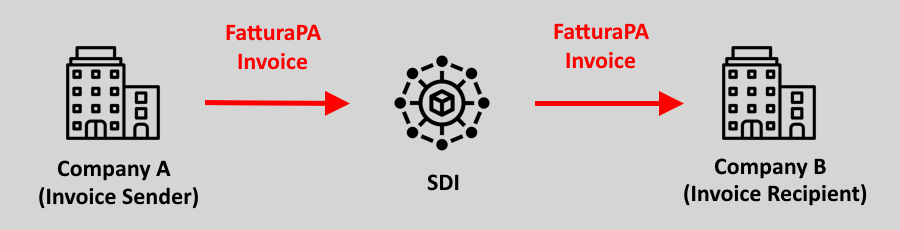

All invoices in Italy must be transmitted through the central platform Sistema di Interscambio (SDI).

Invoices must be written in the standard format “FatturaPA” which relies on XML. Although the SDI also accepts the CIUS-IT invoice syntax, called “FatturaEU”, compliant with the EN 16931, it is rarely used by companies.

The company identifier of the recipient in each invoice must be either the Codice Univoco D’ufficio for B2G invoices or the Codice Destinatario for B2B invoices.

Additionally, invoices can also contain a PEC address, which is the digital version of paper registered mails. This allows the recipient to directly receive the invoices in a dedicated “invoice inbox”. Otherwise, the recipient has to retrieve invoices from the SDI, either manually or using an automated integration.

Of course, in parallel to the transmission of invoices via the SDI, companies are still allowed to exchange a copy of the invoice in a mutually agreed manner, for example a PDF via email, a paper invoice via mail, etc.

Finally, all invoices must be archived for 10 years by both the sender and the recipient.

Cross-Border Invoices

Cross-border invoices do not have to be transmitted through the SDI. Any mutually-agreed delivery method is accepted, such as postal mail, PDF or e-invoices. However, until July 1, 2022, such transactions had to be reported by the Italian company to the tax authority using the “Esterometro“.

Basically, companies had to report their cross-border invoicing data monthly (quarterly since 2020), together with all other invoices that did not pass through the SDI.

This was changed in 2022, and since July 1st that year, e-reporting is mandatory and all cross-border invoices need to be reported directly through the SDI in FatturaPA format as well.

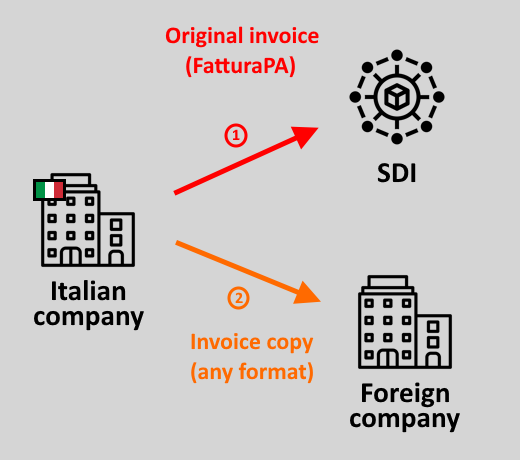

Sending Cross-Border Invoices

All Italian companies need to send their cross-border invoices via the SDI (1), just like any other invoice.

Of course, the foreign recipient will not have access to the SDI. Therefore, the sender has to send a copy of the invoice in a mutually agreed manner (EDI, PDF, paper, …) (2). The FatturaPA invoice is used as the official tax report of the outbound invoice.

The Italian sender must archive both copies of the invoice.

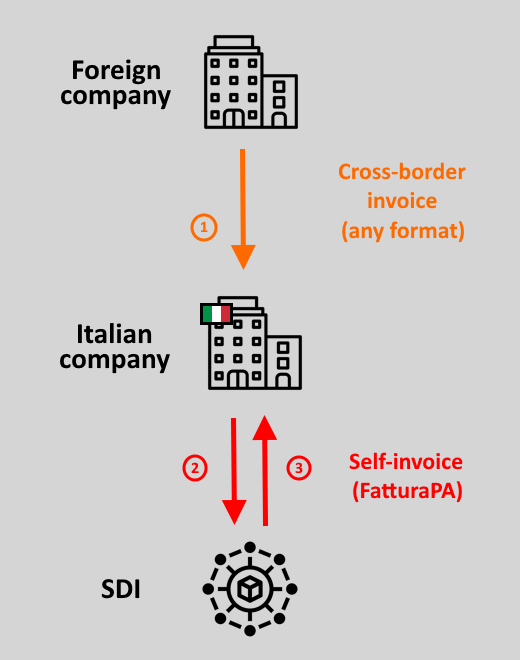

Receiving Cross-Border Invoices

The situation is a bit more complex for Italian companies that are receiving invoices from abroad.

As the invoice sender is a foreign company, it is not subject to Italian law and has no obligation to use the SDI or to send a FatturaPA invoice.

Consequently, after receiving a cross-border invoice in a mutually agreed manner (EDI, PDF, paper, …) (1), the Italian invoice recipient must then re-create this invoice as a FatturaPA “self-invoice” and send it to itself via the SDI (2).

It will then receive this self-invoice from the SDI (3) and only then can the company book that invoice.

Finally, the Italian company must archive both copies of the invoice that went through the SDI: the sender (supplier) copy and the recipient (buyer) copy.

Invoice Archiving

Invoice archiving is mandatory in Italy. The retention period is 10 years and is subject to extensive rules.

More specifically, each company must appoint a “Conservation Manager” who will be in charge of producing a “Conservation Manual” defining the archiving policy & procedures within the company. Then the archiving can either be operated directly by the company, or delegated to a 3rd party. In any case, the Conservation Manager will remain liable from a legal point of view.

The Conservation Manual must comply to the guidelines posted by the Agenzia per l’Italia Digitale (AgID), based on the Italian “Conservazione Sostitutiva” law. Essentially, invoices must be stored in annual packages and each package must be digitally signed to preserve and prove their integrity.

Beyond E-Invoicing: E-Ordering (NSO)

Italy was already at the forefront of e-invoicing legislation by issuing a mandatory B2G mandate in 2015, quickly followed by a mandatory B2B + B2C mandate in 2019.

But Italy decided to go one step further and implemented a procurement mandate as one of the first of its kind. It is mandatory for any public entity operating within the Servizio Sanitario Nazionale (SSN, the National Health Services) to place its orders electronically through a central platform called NSO (Nodo Smistamento Ordini).

This e-Ordering process provides a bit more flexibility than the Italian e-invoicing mandates as suppliers of the SSN can retrieve their orders directly from the NSO platform or through the Peppol network. The latter option makes implementation more convenient for companies operating in multiple countries and are likely already familiar with Peppol.

There is no doubt that such a break-through will be extended to other public entities within Italy, and will encourage other countries to replicate it.

The Invoicing Hub Word

Italy

Italy has been one of the first countries to implement e-invoicing mandates to fight tax evasion. Contrary to other countries like France, they have chosen a “big bang” approach, mandating use of a single central platform on one specific date, which means that all existing EDI connections became obsolete.

Consequently the first few years have proven complicated for Italian businesses with such a big change to implement, including scalability issues of the SDI itself and the complexity of the invoice archiving process. Yet, almost all invoices in the country (more than 30 million annually) are now exchanged electronically in a compliant way.

Overall, Italy has quickly become one of the most mature countries regarding e-invoicing, and its example will undoubtly be followed by many other countries all over the world.

Additional Resources

Public entity supervising the e-invoicing mandates in Italy

Public entity aiming to guarantee the achievement of the Italian digital agenda objectives

Italy B2B central platform

Homepage of the Peppol Authority in Italy managed by AgID

Relevant legislation about e-invoicing in Italy

Guidelines to help economic operators use the SDI and submit FatturaPA invoices

Technical specifications about the SDI and the FatturaPA format

Guidelines published by AgID about the e-ordering mandate

Get your Project Implemented

Gold Sponsor

Silver Sponsors

Advertisement

Latest News - Australia

OpenPeppol conference 2025 – Brussels, June 17-18

ViDA formally published

ViDA clears final step in European Council

EU Parliament approves latest ViDA updates

Next E-Invoicing Exchange Summit to take place in Dubai (Feb. 10-12, 2025)

The Invoicing Hub

experts can help you

Strategy, Guidance, Training, …