This grace period was set up because Romania’s government opted for an ambitious timeline to implement their e-reporting mandate. Indeed, the official decree (law 296/2023) for this mandate was signed on October 26, 2023, with an application start date of January 1, 2024.

Understandably, companies could not be ready in such a short time frame, prompting the government to establish a grace period, initially until March 31, 2024, and later extended to May 31, 2024, for companies to comply. During this grace period, there were no sanctions for companies failing to meet the 5 working day deadline for submitting invoices in the national RO e-Invoice system.

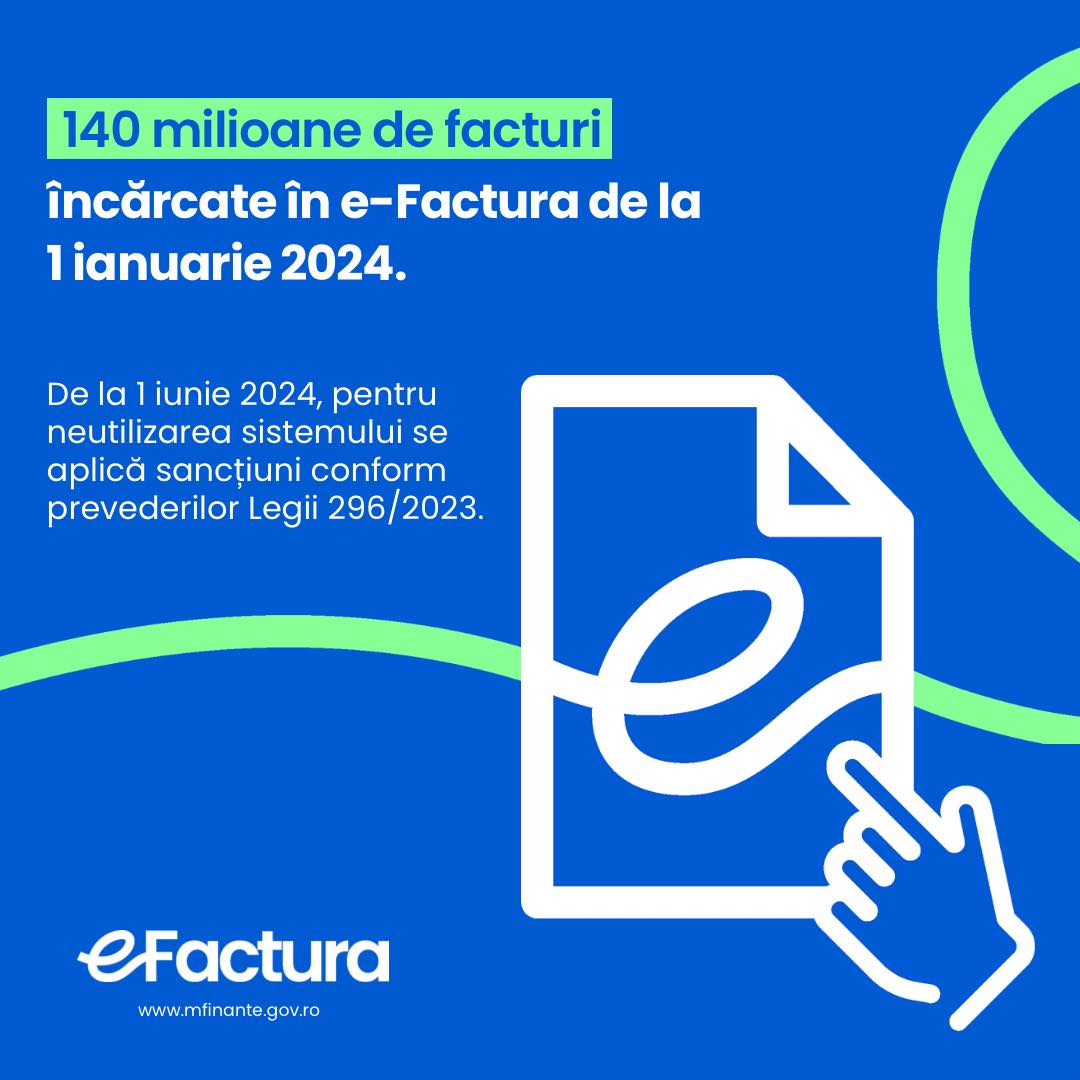

However, this exemption was not extended further, as the government deemed that companies had been given sufficient time to update their processes. Consequently, the grace period has now expired, and non-compliance will be penalized in accordance with law 296/2023, as scheduled.

Official communications have been released on the Ministry of Finance’s Facebook and Twitter accounts.

Next milestone for Romania: July 1st, 2024, with the start of the national e-invoicing mandate.

Make sure to visit our Romania country profile to learn everything about e-invoicing compliance in Romania.

No comment yet, add your voice below!