E-Invoicing in Singapore

Last update: 2024, November 3

Summary

E-Invoicing

Not mandatory

E-Invoicing is not mandatory yet in Singapore, but strongly encouraged via the Peppol network (called InvoiceNow locally), currently in SG Peppol BIS 3.0 format, until a transition to the Peppol PINT SG format on May 30, 2025.

E-Reporting

Will become mandatory soon

E-Reporting will gradually become mandatory via InvoiceNow in Peppol PINT SG format, starting with new businesses in 2025 & 2026.

What the Law Says

E-Invoicing (B2G & B2B)

The Infocomm Media Development Authority (IMDA) has been promoting the Peppol network for several years already under the “InvoiceNow” brand in order to encourage public entities to move to electronic invoicing.

Many public administrations and private businesses accept e-invoices in Singapore Peppol BIS 3.0 format which was adapted from Peppol BIS 3.0 to cover GST (Goods & Services Tax) instead of VAT taxation rules.

However, the SG Peppol BIS 3.0 format is set to become deprecated on May 30, 2025. It will be replaced with a cleaner PINT (Peppol INTernational) – Singapore specialization.

But as there is no official e-invoicing mandate in Singapore, invoicing is still also allowed in other formats:

- Paper-based invoices

- PDF invoices with e-signature or complete audit trail

- EDI

E-Reporting

The IRAS and the IMDA announced in April 2024 an upcoming “GST InvoiceNow Requirement”.

It will progressively apply to all GST-registered businesses, starting with the most recent companies and including any voluntary company:

- From 1 May 2025, for voluntary early adoption by GST-registered businesses, as a soft launch.

- From 1 November 2025, for newly incorporated companies (i.e. within six months from the time they submit their application for GST registration) that register for GST voluntarily,

- From 1 April 2026, for all new voluntary GST-registrants

After these dates, those companies will have to use InvoiceNow solutions to automatically transmit their invoice data to the IRAS, using the Peppol PINT SG format.

Timeline

Singapore & Peppol

E-Invoicing via Peppol Becomes Allowed

Start of the InvoiceNow Network

Peppol PINT SG Becomes the New Standard

Peppol PINT SG Becomes the New Standard

The former Peppol BIS 3.0 format becomes deprecated.

E-Reporting mandatory for new businesses

Technical Details (E-Invoicing)

Peppol Network & Business Identification

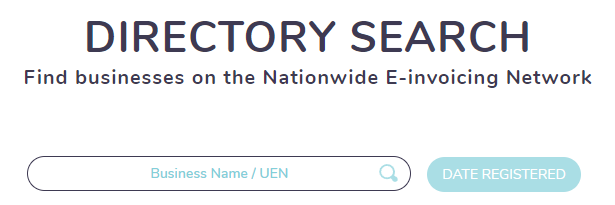

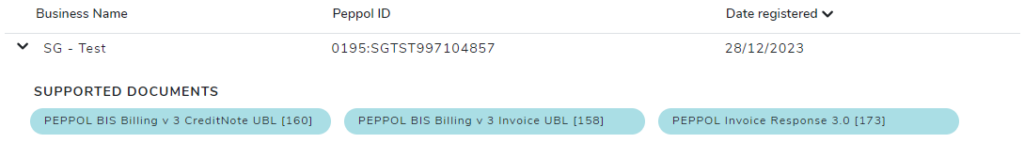

E-invoicing in Singapore relies on the Peppol network, as promoted by the IMDA. In order to facilitate the invoicing process in the country, the IMDA officially recommends the use of the online SG Peppol Directory, dedicated to the Singaporean market.

Businesses can use this tool to find out valuable information about their business partners:

- Their business identifier “Peppol ID” used to properly route invoices on the Peppol network

- The types of documents & formats that this business is able to process (invoices but not only: invoice responses, orders, …)

Peppol Certified Access Points

Not all companies can freely operate on the Peppol network as a certification process for Access Points is required.

Indeed, the Peppol network revolves around a four-corner model where 2 companies who want to exchange documents (e.g. invoices) have to connect to the Peppol network each using an Access Point, usually their e-invoicing service provider. Yet, service providers who want to offer e-invoicing via Peppol to their customers in Singapore must pass an accreditation in order to ensure the validity & security of the solution they offer.

There is a list of IMDA pre-approved Peppol-Ready solution providers maintained by the IMDA.

Large companies that want to setup their own Peppol Access Point can also rely on a list of Peppol infrastructure providers recommended by the IMDA.

Peppol Invoice Format

The e-invoice must be formatted using the “SG Peppol BIS 3.0” format, according to the official Singaporean requirements as described in the official technical specifications. The “Singapore” BIS had to be adapted from Peppol BIS 3.0 to cover GST instead of VAT taxation rules, as well as adding support for SG-specific payment method information.

There is a plan to replace this with a cleaner PINT (Peppol INTernational) – Singapore specialization over 2024 & 2025, comprising the following deadlines:

- By December 31, 2024: all companies on the InvoiceNow network must be able to receive and process invoices in Peppol PINT SG format

- Between January & March 2025: Peppol PINT SG format becomes the default, but SG Peppol BIS 3.0 is still allowed

- Between April & May 2025: SG Peppol BIS 3.0 format will officially become deprecated and will be removed from the network.

Other Methods

Peppol is the recommended e-invoicing method in Singapore, but is not the only solution allowed.

As long as there is a mutual agreement between the sender and the receiver, companies are free to opt for any invoicing solution they prefer, as there is no official e-invoicing mandate in Singapore.

Consequently, invoices sent on paper, PDF (with an e-signature or a business audit trail) or using EDI are also possible options.

Technical Details (E-Reporting)

The Singapore Tax Authority (IRAS) has announced an upcoming “GST InvoiceNow Requirement” that will enforce businesses to automatically transmit their e-invoicing data.

The new requirement will progressively apply to all GST (Goods & Services Tax, the Singapore VAT) registered businesses, starting with the most recent companies and including any voluntary company:

- From 1 May 2025, for voluntary early adoption by GST-registered businesses, as a soft launch

- From 1 November 2025, for newly incorporated companies (i.e. within six months from the time they submit their application for GST registration) that register for GST voluntarily

- From 1 April 2026, for all new voluntary GST-registrants

After these dates, those companies will have to use InvoiceNow solutions to automatically transmit their invoice data to the IRAS.

Still, suppliers retain the flexibility to send invoices to their customers through their preferred channels. Nonetheless, due to the ability of InvoiceNow solutions to transmit invoices directly to their recipients, many companies are likely to transition to e-invoicing, as the need for duplicate transmission of invoices through other channels will be eliminated.

The IRAS will continue to consult industry partners on the initiative and carefully review the feedback received before announcing further details for the remaining GST-registered businesses.

Additionally, the IMDA will publish by May 2025 the list of InvoiceNow solutions that are connected to IRAS, hence able to comply with the GST InvoiceNow requirement.

The Invoicing Hub Word

Singapore

Singapore has been the first country outside of Europe to adopt Peppol (known locally as InvoiceNow) and remains an e-invoicing pioneer in Asia & Oceania, along with Australia & New-Zealand.

E-invoicing is strongly encouraged for all public administrations and businesses, but similarly to its above-mentionned Oceanian neighbours, there is no mandate in place to make the use of e-invoicing compulsory. Consequently, the adoption of e-invoicing remains slow in spite of all the IMDA efforts.

Things will probably change in the coming years with the GST InvoiceNow requirement. While formally an e-reporting requirement, it will force businesses to use InvoiceNow solutions for automated transmission of invoice data to the tax authority, rendering a duplicate transmission via another channel useless.

In the end, more companies will be moving to e-invoicing in Singapore, and the use of the Peppol technology will put them on the rails for global interoperability.

Additional Resources

Tax authority supervising the e-invoicing mandates in Singapore

Public entity in charge of technically enabling the e-invoicing mandates in Singapore

E-invoicing homepage & resources on the IMDA website

Peppol BIS 3.0 & PINT formats technical specifications adapted for Singapore

Official directory of Singaporean businesses and how to invoice them

List of Peppol Access Points certified to operate in Singapore

Get your Project Implemented

Gold Sponsor

Silver Sponsors

Advertisement

Latest News - Singapore

OpenPeppol conference 2025 – Brussels, June 17-18

Next E-Invoicing Exchange Summit to take place in Dubai (Feb. 10-12, 2025)

A brief summary of e-invoicing changes introduced on January 1, 2025

GENA highlights advocacy, expansion and Peppol cooperation

E-Invoicing Exchange Summit coming to Kuala Lumpur (Nov. 25-27, 2024)

The Invoicing Hub

experts can help you

Strategy, Guidance, Training, …