Starting from August 1, all Malaysian companies with a revenue exceeding RM 100 million will have to submit their e-invoices through the MyInvois central platform.

Continue readingE-Invoicing Compliance in Austria: The Complete Guide

The Invoicing Hub now covers a 18th country: Austria, with regular e-invoicing news & detailed country profile.

Continue readingDraft details published: clearing the fog for B2B mandate in Germany

On 13.6.2024, the Federal Ministry of Finance (“BMF”) published the draft of an official letter aiming to clarify open questions surrounding the upcoming e-Invoicing mandate.

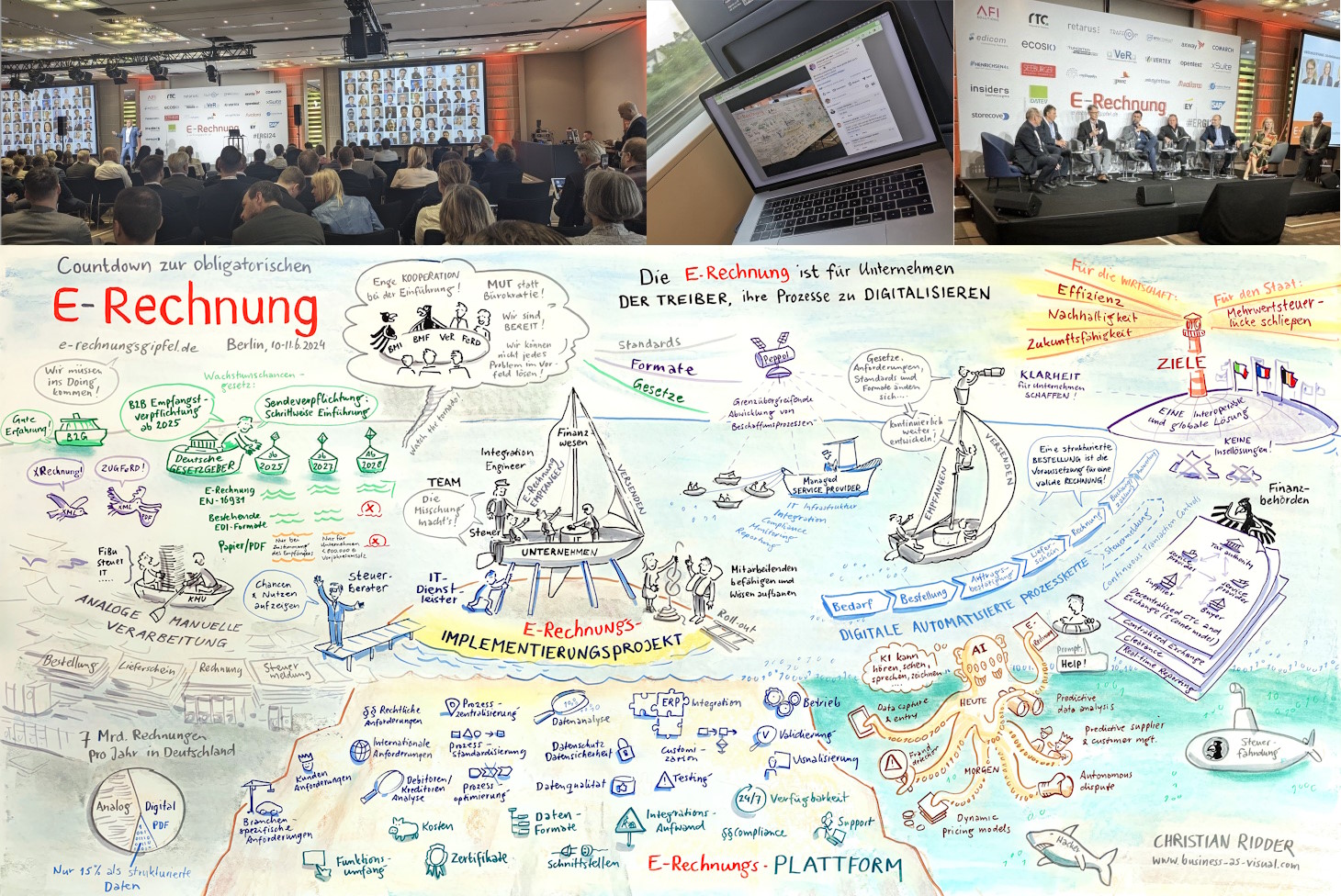

Continue readingE-Rechnungsgipfel 2024: countdown to B2B e-Invoicing in Germany

Taking stock of progress to date, the German e-Invoicing community gathered in Berlin for their traditional e-Rechnungsgipfel on June 10/11, 2024, with many discussions revolving around the upcoming B2B e-invoicing mandate.

Continue readingGENA General Assembly Highlights

The Global Exchange Network Association (GENA) held its General Assembly in Utrecht (NL) on June 6, bringing together a wide range of leading e-invoicing players in the market.

Continue readingPeppol Conference 2024 key takeaways

Evolution of the Peppol BIS format and a potential merger of OpenPeppol & GENA were some of the main announcements made during the Peppol Conference 2024.

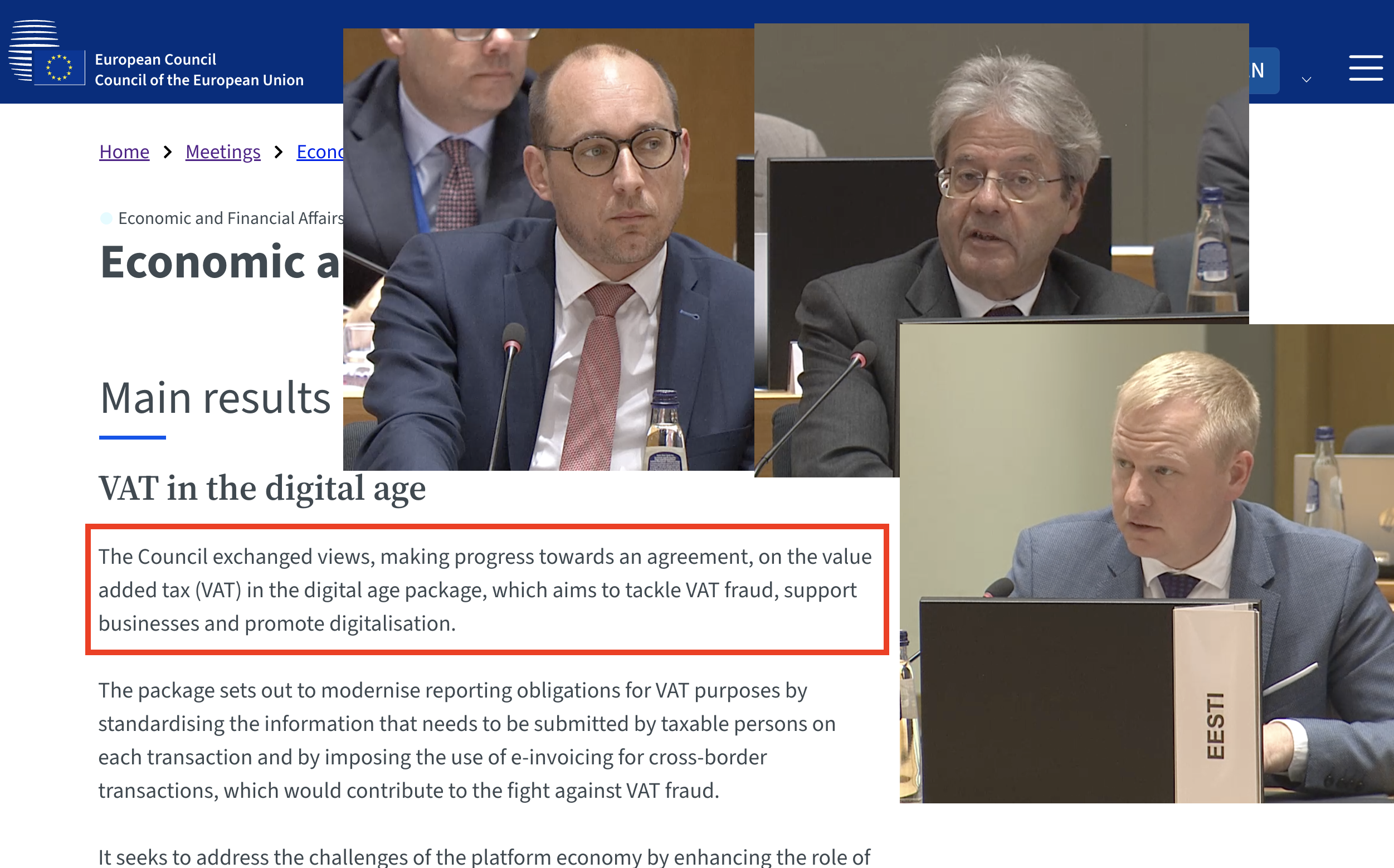

Continue readingECOFIN meeting on 14.5.2024 does not adopt ViDA (yet)

The “VAT in the Digital Age” (ViDA) package achieved unanimous agreement on Digital Reporting (DRR) and Single VAT registration but failed to be adopted due to Estonia’s concerns on tax rules for “deemed suppliers” in digital platforms.

Continue readingE-invoicing will become mandatory in Poland in 2026

New dates have been set at the beginning of 2026 for the implementation of the e-invoicing mandate in Poland.

Continue readingSingapore moves towards mandatory e-reporting of invoicing data

The Singapore Tax Authority (IRAS) has announced an upcoming “GST InvoiceNow Requirement” which will gradually enforce businesses to automatically transmit their e-invoicing data.

Continue readingIt’s official: B2B Electronic Invoicing starts on 1.1.2025 in Germany

Today, on 22.3.2024, the German Bundesrat approved and finalized the German Growth Opportunities Act (Wachstumschancengesetz) including strong political moves towards digitalization of both the private and public sector.

Continue reading